blog One of the Financial Review’s main investigative journalists, Neil Chenoweth (who you may remember from such sterling books as Packer’s Lunch and Virtual Murdoch), has delivered a very important series of articles for the newspaper this morning, publishing 10 years’ worth of financial accounts from Apple Sales International, the iconic technology company’s infamous Irish subsidiary. Chenoweth writes (we recommend you click here for the lengthy and detailed article):

“US tech giant Apple has shifted an estimated $8.9 billion in untaxed profits from its Australian operations to a tax haven structure in Ireland in the last decade, an investigation by The Australian Financial Review has found.”

Delimiter has been banging on about this issue for years. Every year, a new set of Apple financial results are published through the Australian Securities and Investments Commission. And every time those results are published, Apple’s making a stack more revenue but continuing to pay very little tax here, with its claimed Australian profits being significantly less on a percentage basis than the profits Apple lists in its home country of the US.

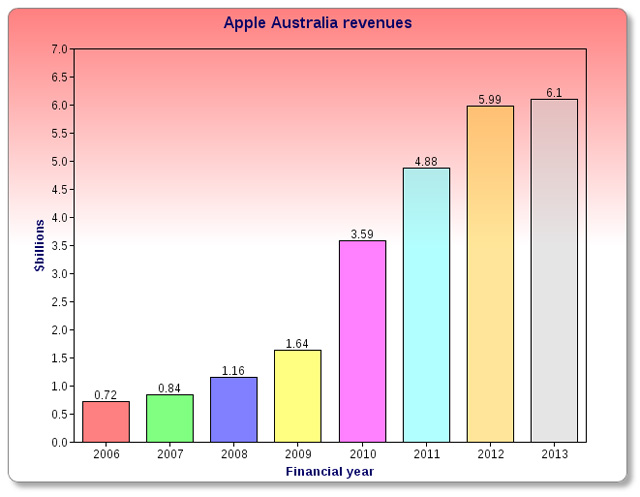

In 2011, Apple made $4.88 billion in revenues from Australia, but paid just $94 million in tax. In 2012, the company made $6 billion, but paid only $40 million. And in 2013, the company made $6.1 billion, but paid just $36 million. You can see a table of Apple’s growing revenues here (sourced from ASIC):

As the Financial Review argues this morning, and as we strongly agree, it should be obvious to anyone with half a financial brain that something is fishy here. Jurisdictions all across Europe are reining in companies such as Apple and Google for their tax habits. It’s time Australia got into the game and stopped letting these billions of dollars go untaxed.

Of course, there are obviously several caveats we should note, before people start lighting the torches and setting out to burn Apple Australia chief Tony King at the stake. For starters, nobody here is saying that Apple’s done anything illegal; it is very likely, as Google Australia has previously pointed out with respect to its own tax affairs, that the company is simply working within loopholes in Australia’s existing tax law, as well as those of other jurisdictions.

In addition, Chenoweth doesn’t have a complete set of data; the journalist only obtained figures from 2000 to 2009; it’s unclear how definite the $9 billion headline figure is.

However, in general we have to agree with sentiments expressed by Labor MP Ed Husic about this situation in January last year. At the time, Husic said: “It’s simply staggering to see Apple make more money but manage to pay less tax in Australia,” he said. “When you consider the massive overcharging that has occurred with some of their products, it seems both Australian consumers and taxpayers are shouldering a heavy load to fund Apple’s bottom line.” Amen.

Image credit: 惟①刻¾, Creative Commons

Where is that graph from? wow. Was the data or excel 95 graph from ASIC?

I’d suggest going after the overseas owned/controlled mining companies first – or if the “loopholes” are closed, then maybe they will work for everyone so no favourites will have to be chosen.

The concept of “they’re not doing anything illegal” irks me a great deal. I can see why they do it, but if they’re also giving BS answers about why their devices cost more in Australia than other comparable markets then it’s taking Australia and Australians for a ride twice over.

It’s just a legal friendly way of saying “if I can get away with it, I will”. It sets a bad example and it’s possible to justify a lot of immoral, but not necessarily illegal, activities with that argument.

Please forgive my naive ideology.

Consumer ‘Australia Tax’: Trick me once, shame on you.

Australian Tax Loopholes: Trick me twice, shame on me.

I have a pitchfork at the ready and fires that need lighting. I just need a political party to vote for that will actually light those fires.

How long can you hold your breath?

there is such a party — a core policy of the Pirate Party, is a financial transactions tax to replace all other taxes. link to some facts and figures about the staggering level of money it would generate from just 1.5%:

http://www.voiceofthepeoplelobbygroup.com/2008/OCTOBER/a_transaction_tax.htm

That’s one scary-looking piece of paper!

But once we get past the truly awful page layout and the atrocious spelling/grammar, we can see some of the old black magic. So I delved back in our recent past, and:

http://www.australianbankingfinance.com/banking/opinion–bank-levy-is-a-bad-tax-idea/

{term of endearment}, I hate to tell you this, but that idea is so old its white hairs have got white hairs. The concept is quite simply brilliant. And that’s the trouble. The “simply” and “brilliant” I mean. The problem is, the sums that should add up, for some reason, don’t. And the reason is, that every similar scheme relies on one and only one foundation: the use of bank accounts. Once the plebs cotton on to that bit, they head straight for the hills. It happens with GST, although hard cash transactions in large amounts are difficult to hide. But people still try…

The question to pose is this: “Why did the Feds drop the FID and BAD taxes?” The fact is, they were enormously profitable despite the negativity in my previous paragraph. OK, there was some horse-trading with the introduction of the GST, but OTOH, when you’re on a winner, why get off?

As a counterpoint, mining is represented by something in the order of 83% foreign ownership.

So whilst it’s unfortunate existing Tax Laws have loopholes (almost all legislation does) it’s relevant to note those same laws are highly unlikely to change any time soon.

Because to close loopholes that affect where profit can go, will be felt across any number of industries.

That and I doubt a Coalition government will be keen to put the mining industry to the sword; but given the Automotive Manufacturing industry outcomes, anything is possible.

That and the $882m payout from the ATO to News Corp might re-ignite some fires.

It’s not illegal if the tax system allows it; labelling it as such doesn’t really help.

Whether it’s moral, immoral or offensive is an entirely different question.

How much GST did they pay?

Apple doesn’t tend to pay much GST themselves … they just collect it and then pass it on.

If Apple is moving their profits offshore, whatever they charge Apple Australia for the product is going to attract GST, and they pay a good portion of it. A side product of them siphoning profit out of Australia.

When this came up a couple of weeks ago I went through some basic numbers. In short, at the point it hits Australia, GST is paid. Has to, to get through Customs. So Apple Ireland gets slugged. Thats the point where they stop caring, the GST paid by them and is absorbed by Apple Australia, then passed down the chain.

The profit margin each step of the chain makes though from the import onwards is still going to get hit by the 10%. Dont worry about GST, its getting paid by Apple at every relevant point, and in the end, if an iPad costs $800, there is $72(ish) GST collected. Most of that is actually paid by Apple Ireland, as they get slugged with the GST on the manufacturing costs as well as their siphoned profit.

With Apple though, because there is a real product as part of the process, there are extra complications – with any money being siphoned, even if they find a solution, where should it be taxed? Where its built, where its sold, or where the company is really located? China, Australia, and the US all have fair claims.

They are better off looking at companies like Google, Ebay, or Amazon, who dont have a manufacturing cost to suck up a big portion of the turnover. Those excuses are far harder to explain away, and it should be easier to figure out the siphoned amount and get it back into an appropriate tax jurisdiction. Or Starbucks, where by their very nature has no exports, yet their profits are siphoned to Bermuda as well.

Ultimately, 10% of whatever the shelf price is. That includes the portion that left Australia, as one of the basic rules of GST is that if its connected to Australia it gets taxed, and imports fall into that category.

There are a couple of little rules around that which can mean GST isnt collected at the import point, but they wouldnt apply here. In short, if you import something that costs less than $1000, Customs doesnt bother assessing GST. As they import in bulk, its not a rule they can use.

Apple collects it from its customers don’t they by convincing them that spending $X on an Apple device is a good way for that customer to manage his budget? Just like the payments their customers pay to Apple contain an “element” of income tax. All this “passing on” propaganda is a way to con people into thinking someone else pays.

I can’t see any essential difference.

Land Tax is based on fictitious valuations of unimproved land even in areas where there are no sales of unimproved land to base valuations upon. Income Tax could be based on any formula a government wants; say a notional percentage of sales to Australian residents.

Tax evasion on this scale will only become easier and more commonplace if Australia signs the TPP. And mugs like us who work for a living and can’t afford offshore tax havens and creative accountants will have to make up the inevitable shortfall.

The issue here is not with Apple. It actually relates to government legislation (here in Aus and overseas).

As far as I am aware, Apple are able to siphon out the revenue to overseas subsideries due to double taxation agreements we have with a number of companies. (amongst other things).

Where the sting in the tail is that the Irish government has apparently done a deal with Apple where they get a discounted tax rate on profits made in the republic.

So… How do we fix it? One argument would be lowering the Australian company tax rate (this has been mooted previously) and make it more attractive for Apple to pay tax locally. Another option is for the various governments to curb their international taxation laws to stop this from happening?

BUT… why would Ireland do that? They are better off having Apple pay a lower tax rate there than pay no tax in Ireland at all.

Its also important to remember that Australia is not isolated in this situation, Apple (and other companies) do this around the world. I bet you that Apple does the same thing in its home market of the USA as well.

No, there is plenty of issue with Apple, dont worry about that.

Here’s it in a nutshell. An iPad costs $300 to make, with a shelf price of $700 – add GST and round up, thats $800 here. When its made, it goes via Apple Ireland, who own the rights. So they pay $300 to China Inc to make it, then charge $600 to Apple Australia. Apple Australia charges JB HiFi $700, and JB charges $800. Apple Ireland pays about $55 GST, rest is moved offshore to Ireland then Bermuda. Net result, $250 Apple makes effectively tax free.

The $100 Apple Aus (or $200 when they sell it themselves for $800) makes is absorbed by their local running costs (staff, rent, etc) and hence magically break even in Australia, or near enough. JB makes a profit, but Apple dont care about them – their whole goal is that Apple Australia makes $1 profit.

They do that with what Apple Ireland charges. The amount between that, and what Apple Aus onsells for, is a smaller amount than it should be. At least, thats the accusation.

So the question for Australia is.: Should Apple Ireland be charging $600 for the product, or should it be lower? They charge lower, and Apple Aus still onsells to JB HiFi for $700, then Apple Aus is making more, and hence paying more company tax.

Apple is controlling this through manipulating how much profit their endmarket businesses are making. And thats a delibrate act on their part, making them as much a part of the problem as the loopholes they are using. They want as much money between the manufacturing part, and the endmarket import as they can get, because thats what goes through the tax treatment.

I agree with what you are saying GongGav, but really do you blame Apple?

You cant tell me that when you do your tax return every year that you dont make any claims to maximise your refund???

What Apple have done is completely and totally legal. Whether they should be able to do it is what is in question and therefore its up to governments (plural) to fix that.

Personally, I believe the tax system in Australia is relatively robust, however it is obvious that loopholes exist.

A good example of a loophole at the personal level are negative gearing arrangements. Does that mean if you reduce your tax because you have entered one of these arrangements, you are morally corrupt and not meeting your obligations to the rest of Australian society? Of course not, negative gearing is seen as a prudent and fiscally responsible investment choice.

This type of prudent financial choice is exactly what Apple are doing.

When I do my return, I claim what I can. As I work in the tax system, I know what I can and cant claim, and also know the problems if I cheated my taxes. Basically, I’d be out of a job. I dont top up my claims, and dont really need to. Couple of annual donations, income protection, and health rebates add up surprisingly fast.

And sorry, I’m not saying Apple is doing anything WRONG, but that they are part of the problem, and making delibrate decisions while being part of the problem. Not decisions to move money into Ireland, I dont have much of a problem with that, but how MUCH they are moving is something they are manipulating.

Look, its pretty simple. It costs $300 to make a 64 Gb iPad, and they charge Apple Aus something like $600 for it to come into Australia. $300 of that covers manufacturing, $50 covers GST. $250 toddles off to Ireland to get laundered, and thats where the issue is – is $250 the right number, or is it too much?

If its too much, a portion should probably stay in Australia, but if they determine its only $50 over, thats only about $16 in taxes, and thats not going to add up. Wont be the billions people seem to assume, it will be closer to $200m, and then people whine that they are only paying 4% of their turnover. The followon problem the US has is they want the remaining $200 to be taxed in the US. Thats where all this is headed, and it flies in the face of international tax law covering the past 300 plus years.

Apple delibrately sets their import costs up so that the local branches make minimal profit, while keeping that import cost low enough the governments around the world cant use transfer pricing laws against them. Even if they are overcharging the local branches, there is still a healthy portion of the cost that is legitimate.

I’m not defending Apple. I’m saying that for Australia, the problem isnt as big as people think.

Go look at Woolworths annual reports, look at their turnover, and net profits after tax. They pay about the same percentage in taxes as Apple Aus does, yet people accept it. Why is that?

Comments are closed.