news Technology giant Apple has revealed it had a record year in terms of revenues and profits from its Australian operation over the past year, raking in revenues up 23 percent to almost $6 billion, as new iPad and iPhone launches sent the company’s finances into the stratosphere over the past 12 months.

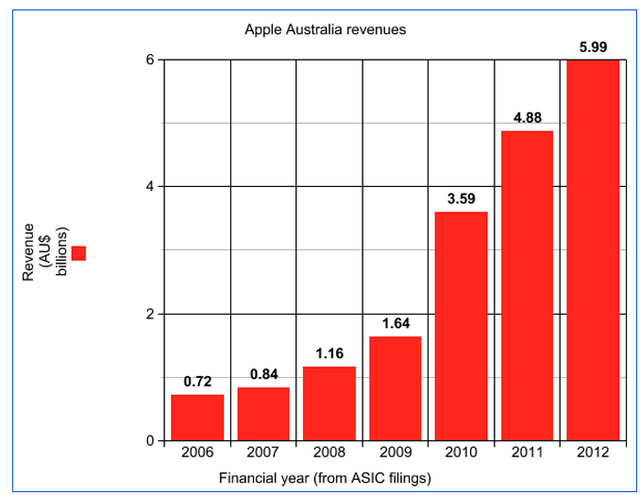

The figures were revealed in Apple’s Australian financial results published with the Australian Securities and Investments Commission, shortly after the company released its global quarterly results in the US. They show that over the year to the end of September 2012, Apple pulled in local revenues of $5.99 billion over that year, up 22.9 percent from the previous year’s figure of $4.87 billion.

The company made gross profits of $493.1 million after the cost of goods sold were taken out of its equation, with net profits coming in at $98 million. The company’s largest expenses, apart from the cost of goods sold, which is an internally calculated figure charged by Apple Australia’s US parent, were sales, marketing and distribution expenses of $296.2 million (up from $215.3 million the previous year) and administration expenses of $45 million. The company disclosed that it paid local income taxes of just $40 million, off net profit of $98.6 million.

The past 12 months have also seen Apple Australia massively increase its headcount. In the previous year it had 1,505 staff, but at the end of September 2012 that figure had jumped to 2,418. It is believed that the massive jump in headcount was primarily due to the ongoing expansion of Apple’s own retail stores around Australia, with the company rapidly adding new stores in a range of diverse locations throughout the nation over the past several years.

In its financial statements, Apple attributed the “momentum” in its growth in Australia to “the release of new products such as the iPhone 4S and iPhone 5 as well as new iPad into Australia and New Zealand”, as well as “further retail expansion in Australia”.

If you examine Apple’s Australian financial results for the past half-decade, it’s clear that the company’s launch of innovative new product lines such as the iPhone, iPad and new versions of its iPod, MacBook and iMac lines, as well as subsidiary products such as its iTunes app and music stores, have had upon its business. In 2006 in Australia, Apple was making less than a billion dollars in local revenue. However, the company then grew steadily throughout the next several years, and saw a substantial jump in 2010 after the first iPad was launched.

In addition, there is also reason to suspect that Apple Australia’s revenues will grow further in the next 12 months. Last week Apple released its global quarterly results, representing the first full quarter since the company released its new iPhone 5 and iPad mini models. The results represented record revenue levels for Apple and also some of the highest revenues of all time for any company in any given quarter.

“We’re thrilled with record revenue of over US$54 billion and sales of over 75 million iOS devices in a single quarter,” said Tim Cook, Apple’s CEO. “We’re very confident in our product pipeline as we continue to focus on innovation and making the best products in the world.”

“We’re pleased to have generated over US$23 billion in cash flow from operations during the quarter,” said Peter Oppenheimer, Apple’s CFO. “We established new all-time quarterly records for iPhone and iPad sales, significantly broadened our ecosystem, and generated Apple’s highest quarterly revenue ever.”

The next time Apple is likely to release yearly financial results in Australia will be January 2014, when the company will release results for the year to the end of September 2013. This period will include the final calendar quarter of 2012, and will give the first real picture of how the company’s Australian financial results will be impacted by the release of the iPhone 5 and iPad mini.

There is one significant anomaly in Apple Australia’s financial results from a profit perspective compared with its global results. In Australia, the company only made a relatively small net profit — $98.6 million, off top-line revenues of almost $6 billion. However, globally, the company in its most recent quarter made a significantly higher net income figure as a proportion of revenue — $13 billion off revenues of $54.5 billion. As a proportion of revenues, Apple’s cost of goods sold in Australia is significantly higher than it is globally, meaning the company pays little tax in Australia compared with its global tax situation.

The news of Apple’s financial results comes as the Australian Government has recently outlined a series of new legislative initiatives with which it will attempt to protect its corporate tax base and rein in the tax minimisation strategies of corporations such as search giant Google and Apple, which are both known for their tax minimisation strategies including offshore corporations in locations such as Ireland.

The Government has announced measures specifically designed to tackle the issue of Australian subsidiaries such as Apple Australia from dealing unfairly with their US parents – such as in the financial accounting of the cost of goods imported by the local subsidiary but manufactured overseas by its global parent.

Last year, Communications Minister Stephen Conroy said in a said new so-called ‘transfer pricing’ legislation would be introduced by the Federal Government shortly to deal with this kind of behaviour by multinationals operating in Australia. The text of the Tax Laws Amendment (Cross-Border Transfer Pricing) Bill (No. 1) 2012 (PDF here) states that the object of the legislation is to ensure that profits would be brought within reach of the Australian taxation system which would have accrued to an Australian entity if it had not been dealing at proper arm’s length terms with its foreign associated entity.

In addition, a statement by Assistant Treasurer Bill Shorten in November last year stated: “Transfer pricing refers to the prices charged when one part of a multinational group buys or sells products or services from another part of the same group in a different country. The prices charged will impact their level of profits, and therefore the amount of tax they have to pay, in the respective countries. These rules require multinational firms to price intra-group goods and services to properly reflect the economic contribution of their Australian operations.”

opinion/analysis

In January 2012, when Apple released its last set of Australian financial results, I wrote:

I’ve never seen anything like this level of revenue growth from any other technology company operating in Australia. The only example I have to compare it to would be the massive jump in local revenue experienced by networking giant Ericsson in the 2006 calendar year, when it booked $1.4 billion in revenue — up from $557 million the previous year. However, that jump was only temporary — and was caused by a billion-dollar contract Ericsson signed with Telstra to build its Next G network.

All indications are that with the expected launch of the iPhone 5, iPad 3, new Macs and MacBooks in 2012 and possibly even an Apple television of some kind — plus the ongoing growth in digital product sales through its iTunes store (particularly eBooks, music and apps) — Apple will continue its growth throughout 2012 and beyond.

With this in mind, I’m not even really sure what we’re dealing with here. I’m sure we’ll see Apple Australia booking $6 billion in annual revenue — that figure doesn’t seem much of a stretch, given its current levels of growth and the new products to come. But will we see a $10 billion Apple Australia? Or even larger? At that point, Apple Australia would be approaching half the size of Telstra in pure annual revenues. It would probably be bigger than Optus in terms of pure revenue. Its revenues would likely be as large in Australia as HP and IBM combined.

I’m sure that Apple knows this already … but that’s a ridiculous scale. At that point you can pretty much do whatever you want. Enter whatever market you want. Buy whatever you want. You can set your cash on fire and burn it for years on end without even making an appreciable dent in your money pile. The phrase “Do you like my hat? It’s made of money!” comes to mind.

Apple isn’t just a huge global business. It’s becoming one of Australia’s largest, most valuable and most dominant businesses of any stripe. And now we have the figures to prove it.

Yes, I predicted Apple Australia’s 2012 revenue almost to the dollar :)

In general these comments still stand, and I would add that I believe it very likely that Apple Australia will push towards the $7 billion revenue mark or higher in its next set of Australian financial results. This is a massive company and a huge part of the Australian economy. With this in mind, I hope that the Australian Taxation Office is keeping a close eye on Apple Australia’s finances. The company is pulling huge sums of money out of Australia at the moment. Taxes of $40 million, off revenues of almost $6 billion? That hardly seems fair.

Image credit: Apple, graph from Create A Graph

Its interesting that Apple have stated they will now be putting a maximum on the revenue projections in the US to enable the market to separate fact from analyst fantasies. Seen as of the causes of the recent price drop in their stock when they did not meet the unrealistic expectations set by Wall Street.

It will be interesting to hear what taxes Apple paid in Australia on $6B

Well, according to the article you’ve commented on, they pay $40 million in tax.

A cynical person might think that Apple’s accountants are shifting a costs to their Australian operations to avoid paying tax here and make bigger ‘profits’ in lower taxing jurisdictions.

Apple Inc.s accounts include a large provision for deferred tax, which arises from cash left overseas but not brought back to the US, and so not yet taxed in the US. Of the $139B cash (or equiv.) Apple holds around $90B offshore, perhaps some in Australia.

So it would be interesting in the Apple Aust accounts to know if the charges from the US parent are unpaid expenses ie owed by the Aust. subsidiary but not yet paid. That is the cash is in an Australian account but as yet unpaid though accounted for as an expense… so as to reduce the tax in Austraila… which is why we have the GST to catch some of the money moving through the system….

My understanding is that the huge majority of that cash was transferred by the double-Irish-Dutch-sandwich mechanism through to their corporate financial headquarters, the Bahamas. Thus avoiding all but the most nominal of taxes.

This is why it’s hard to directly access this cash pool, they’d have to pay US taxes on at least a proportion of it.

It’s worth also noting that Apple’s *minimum* profit margin on retail is 20%. This is actually staggeringly high for IT products, especially in a commodity sector.

That tax figure is extremely unimpressive. Someone appears to have been doing some off-shoring if Apple is saying its profit margin is all of 1.6%. Or their shareholders would be in an uproar.

Governments need to be getting global trade organisations that are so keen on free trade to look at tax impacts and global taxation as well. At the moment, all that’s happening is the tax burden is shifting from businesses (and their 1% owners) to salary earners.

I recently ordered an ipad mini. I ordered it from the Australian Apple Store, paid in Australian Dollars, it was delivered by a local firm on the launch day I assumed from Australia. When the invoice arrived with the goods I was surprised to see that it came from Apple Singapore… I’m guessing this is how tax is shifted offshore…

Looks like overcharging to me. Pity the poor customers.

Comments are closed.