news NBN Co’s Strategic Review has found that it will not be possible to deliver the Coalition’s stated policy goal of delivering broadband speeds of 25Mbps to all Australians by the end of 2016 or at the projected cost, and has recommended that up to a third of Australian premises theoretically already covered by HFC cable networks effectively receive no upgrade at all under a drastically revised deployment scheme.

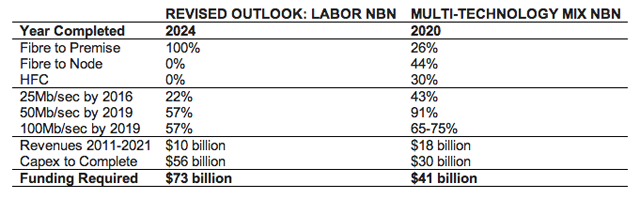

When the Coalition released its rival NBN policy in April, it based the policy on the core pledge that the party would deliver download speeds of between 25Mbps and 100Mbps by the end of 2016 — effectively the end of its first term in power — and 50Mbps to 100Mbps by the end of 2019, effectively the end of its second term. According to the Coalition’s statement, the 25Mbps to 100Mbps pledge applied to “all premises”, while the higher pledge by 2019 applies to “90 percent of fixed line users”.

The detailed policy document disclosed that these speeds would predominantly be delivered over the long-term with fibre to the node technology through upgrading Telstra’s existing copper network, focusing on areas where “the poorest broadband” services are currently suffered by residents and businesses. By the end of 2019, some 71 percent of premises were slated to be covered with fibre to the node infrastructure.

In some other areas — such as greenfields housing estates, and “wherever copper has to be replaced” — such as areas where Telstra’s copper has degraded — fibre to the premise technology, as under Labor’s current NBN plan, would be deployed. The Coalition estimated that some 22 percent of premises would be covered by FTTP under its plan. The remainder of premises, as under Labor’s NBN plan, would be covered by satellite and fixed wireless technologies.

However, in its landmark Strategic Review document published today, and available online in PDF format, NBN Co instead recommended a drastically reduced rollout schema, which it dubbed an “Optimised Multi-Technology Mix”).

In this mix, FTTP-style broadband would be deployed to some 24 percent of Australian premises located in metropolitan areas by the end of 2020, with another 32 percent to receive FTTN infrastructure, 12 percent to receive Fibre to the Basement or similar and a large 30 percent to receive effectively no upgrade, considering that percentage is already covered by the HFC cable networks operated by Telstra and Optus. This rollout in total would cover 93 percent of the population.

In remote areas (the remaining seven percent of Australia), 10 percent of those areas would be covered by FTTN, 53 percent by fixed wireless, and 37 percent by satellite.

In a statement, NBN Co claimed this this “new look NBN” would “resemble the architecture of similar broadband rollouts in other advanced economies, embracing a range of technologies including Fibre to the Node and HFC alongside Fibre to the Premises, fixed wireless, satellite as well as future advances in telecommunications technology.”

The company said this approach should be able to deliver access to wholesale speeds of up to 50 Mbps to 90 percent of Australia’s fixed-line footprint and wholesale speeds of up to 100 Mbps to 65 percent to 75 percent by 2019. The company also claimed it would reduce costs and bring forward revenues for the company, reducing peak funding from what NBN Co has newly estimated at $73 billion under Labor’s NBN plan to $41 billion under its revised outlook. This figure is $11.5 billion more than the Coalition promised in April.

“… the accumulated delays and state of NBN Co mean the Government’s aim of ensuring nationwide access to fast broadband by 2016 cannot be achieved,” said Communications Minister Malcolm Turnbull in a statement this morning. “The Government will work with NBN to search for ways to accelerate the rollout in its early years.”

NBN Co’s new executive chairman Ziggy Switkowski claimed in a statement that the approach that NBN Co had recommended to the Government would delivery “very fast broadband to homes more quickly and at less cost”.

“We will do this by investing taxpayers’ money appropriately on the right technologies at the right time, by translating a long term milestone into a rolling series of realistic and actionable near term plans, and by being alert to upgrades in technology and shifts in consumer needs,” wrote Switkowski.

“By 2019 more people will be able to access higher speed broadband than would have been the case had the previous plan continued on its current trajectory. What’s more, viable economically attractive upgrade paths currently being trialled internationally are capable of providing speeds well beyond 100 Mbps and can be deployed as consumer demand increases over time.”

However, it does not appear as though NBN Co’s new ‘Optimised MTM mix’ is currently possible to deliver, based on the company’s current commercial relationships and the state of Australia’s technology sector.

A large number of premises currently covered by the HFC cable footprint, which NBN Co is planning to use to provide broadband to some 30 percent of metropolitan Australian premises, cannot connect to the HFC cable networks, as they live in so-called multi-dwelling units such as apartment blocks, or work in office environments where multiple offices are in the same facility.

Neither Telstra nor Optus are currently willing to connect such facilities to HFC cable unless the whole building is connected; something most landlords are currently unwilling to pay for. This will mean residents and business users in those areas will likely remain using ADSL2+ technology, which typically only delivers speeds of up to 16Mbps. Theoretically it can go a little higher — up to 25Mbps, but few Australian users see such speeds in practice, even if they are close to their local telephone exchange. The overwhelming of Australians in the HFC cable footprint are not using the technology, due to its inflexibility and cost, and the inability of many to get it connected.

Secondly, the HFC cable networks operated by Telstra and Optus are not open to wholesale access and are not regulated for price. NBN Co cannot currently provide Internet services over such networks unless the ACCC or the Parliament forces Telstra and Optus to open their HFC networks, or to sell that infrastructure to NBN Co. Neither Communications Minister Malcolm Turnbull nor Switkowski were able to answer questions this morning on how NBN Co would gain and control access to such networks, or how it would force Telstra and Optus to offer certain prices on the networks.

The NBN Strategic Review also found significant problems with Labor’s existing NBN policy. It estimated that Labor’s all-fibre NBN will cost $73 billion and take until 2024 to complete, and increase average broadband bills by up to 80 per cent to meet the rate of return targeted by the former Government. NBN Co’s persistent inability to meet its targets reflected “a lack of deep internal experience in complex infrastructure, construction projects and project management”,” the report found.

Key decisions were taken “without appropriate commercial rigour and oversight”, it added, and NBN Co’s previous leadership clung to unachievable Corporate Plan forecasts “notwithstanding clear factual evidence to the contrary”.

However, compared with NBN Co’s new ‘Optimised MTM’-style rollout, it appears clear that Australians, and the telecommunications industry as well, would still be significantly better off under Labor’s original NBN policy, even if it was delivered four years late and at a cost around $30 billion more than originally planned.

This is because the construction of the NBN would result in all Australians achieving significantly upgraded broadband services, with 93 percent of the population having access to gigabit speeds under the planned FTTP rollout. Under NBN Co’s new plan, a significant percentage of the population would receive little to no upgrade compared to their current access. In addition, unlike FTTP and FTTN, HFC cable infrastructure is a shared medium at the local network level, meaning it will likely suffer from congestion issues as additional users are added to the network.

The extra $30 billion NBN Co now estimates Labor’s original NBN policy will cost, and the extra four years it estimates it will take to complete the project, are not viewed as statistically significant factors by most technical commentators, due to the long-term nature of the NBN project, in that it will deliver infrastructure that will provide services over the next 50-100 years.

NBN Co’s new model would likely see demand for upgrades starting from when it was slated to be completed in 2020, whereas Labor’s original NBN model would not need to see its fibre upgraded in the foreseeable future.

NBN Co’s new rollout plan is not the first time that allegations have arisen that the Coalition is planning to ignore Australia’s areas ‘covered’ by existing HFC cable areas. In February 2013, then-Communications Minister Stephen Conroy challenged then-Shadow Minister Malcolm Turnbull to confirm his rival broadband policy would not see fibre to the node technology immediately deployed to areas already covered by the HFC cable networks operated by Telstra and Optus, despite the fact that few used the ageing HFC networks.

Subsequently, Turnbull confirmed that metropolitan areas of Australia in the HFC cable footprint of Telstra and Optus would not immediately receive the Coalition’s planned fibre to the node upgrade if the Coalition won Government and did not commit to deploying FTTN infrastructure in those areas in the long-term.

Image credit: Office of Malcolm Turnbull

Told you so. Over and over again I said they wouldn’t do anything for people with HFC or in HFC areas.

Actually they will do something for HFC areas. Its in the review, feel free to have a look. Its small but an upgrade apparently is in there for HFC areas.

I dont believe any of the figures contained in this review, key percentage and $ values are missing that have nothing to do with commercial in confidence and Malcolm purely did that to hide the truth.

Also note the draft was completed 2/12 with this final release of 12/12, why 10 days difference?

“Also note the draft was completed 2/12 with this final release of 12/12, why 10 days difference?”

Page 9: “The Strategic Review was undertaken by NBN Co over a period of five weeks from 28 October 2013, concluding with the submission of a draft report on 2 December 2013 and, following Board approval, this final report to the Minister for Communications and Minster for Finance on 12 December 2013.”

Hmmm… 2/12 – 12/12, doesn’t matter, they missed their target?

What was the reason?

Asbestos, Contractors or other such “excuses” we can just ignore? No, there was no reason, it’s just quite ok isn’t it?

Perhaps their non-NBN internet speeds were so woeful they just couldn’t get the info to each other in a timely fashion.

:/ Amazing

They cut 1/3 of the houses because based on their number FttN to 100% would cost $60 Billion compared to optimised FttP $64 Billion to 100%

Why was FttP + HFC not priced?

If you remove ~20-30% from FttP cost you get ~$45 billion basically the same as the mix but far superior!

Scratch that Scenario 4 in the Strategic Review

FttP 63%

FttN 5%

HFC 32%

COST $51 Billion Slightly more than mix

Cash Flow positive FY22 Same year as mix but less upgrades needed and more profitable after FY22

Why is this not the option chosen?

It is more profitable and the asset will be worth far more

You are spot on.

Why aren’t they choosing Scenario 4? for ~$10bn you cover 37% of premises with FTTP instead of FTTN.

The upgrade cost of that 37% would surely be greater than $10bn for that many premises.

This is the point I tried and failed to make below…

Where are the reporters, particularly the finance ones, atm? Missing in action? This is critical.

For the same reason FTTH to 93% isn’t chosen, even though that network would cost the least in the long run; the more important point however is that the concept of “cost” is utterly irrelevant since the network will pay for itself and actually return money to the government. No self-respecting financial analyst would worry about initial outlay for a revenue generating project backed by a sovereign government with the ability to issue as many bonds as required to ensure the project is seen to completion.

“For the same reason FTTH to 93% isn’t chosen, even though that network would cost the least in the long run;”

How is that?

“the more important point however is that the concept of “cost” is utterly irrelevant since the network will pay for itself and actually return money to the government.”

In all scenarios the network will pay for itself, but the other scenarios need lower funding, need to raise and service less debt, have a higher IRR. and will pay for themselves decades earlier.

“No self-respecting financial analyst would worry about initial outlay for a revenue generating project backed by a sovereign government with the ability to issue as many bonds as required to ensure the project is seen to completion.”

The report was written by some of the most respected financial analysts and consulting firms in the world.

“For the same reason FTTH to 93% isn’t chosen, even though that network would cost the least in the long run;”

How is that?

You don’t ever need to upgrade to FTTH, it uses less electricity. Less technologies and systems required to support different endpoints. You need less contractors because you can train and keep contractors knowledgable in a single technology; instead of needing to know both technologies.

It has higher earning potential because it can sell higher capacity services.

It has and will have less faults because it doesn’t use the many-years-old copper network for any part of the communication.

In the long term, it is cheaper.

“You don’t ever need to upgrade to FTTH, it uses less electricity. Less technologies and systems required to support different endpoints. You need less contractors because you can train and keep contractors knowledgable in a single technology; instead of needing to know both technologies.

It has higher earning potential because it can sell higher capacity services.

It has and will have less faults because it doesn’t use the many-years-old copper network for any part of the communication.”

The strategic review takes each of the above into account and shows that in both the short and long term FTTH is more expensive, requires $32bn (78%) more funding, takes 4 years (80%) longer to deploy, its IRR is 114% less and that a possible future upgrade to FTTH would be cheaper than building it now. It also shows that majority user demand now and for the foreseeable future does not indicate a pressing need for the higher bandwidth. However majority user demand shows a need for 25Mbps now and 50Mbps in the foreseeable future.

Hi steve

I see you endlessly bagged the previous govt. and NBNCo for changing their minds pre/post election re: network topology and missing roll out targets (and never said well done for what actually was achieved)…

Being so, I find it odd that you “curiously” don’t appear to be using the same rules/logic in relation to the new govt.

Are you going to ever bag the new govt./NBNCo (as you did the last mob) for missing their review target, changing topology ratios pre/post election and blowing the budget?

And unlike the last mob who did achieve a lot if you actually want to see it, the new kids in town have achieved absolutely diddly, zilch, nothing, SFA and already failed…!

Apparently that’s all just fine is it?

:/ Amazing

“COST $51 Billion Slightly more than mix”

$10bn additional peak funding

“Cash Flow positive FY22 Same year as mix but less upgrades needed”

Deferring upgrades saves money due to the time value of money.See table 4-4. Less upgrades needed isn’t a good thing.

“It is more profitable”

No. 12% less IRR, so less profitable

“and the asset will be worth far more”

assets begin depreciating immediately and technology becomes obsolete quickly. Deferring technology expenditure until necessary is better financial management because of the time value of money, because you save on depreciation, because the upgrade path is cheaper than building now and because it gives you the flexibility to respond to changes in demand, changes in competition, changes in technology and changes in the market.

Since the government has put a ceiling of $29.5bn on government equity, the remaining will need to be funded by debt raised. This is not an easy proposition. Raising an additional $10bn is not easy.

So basically you are saying that FttN can make more profit once it is cash flow positive this is not based on facts.

The second statement not based on facts is you suggest that fibre will be obsolete in the near future that is not correct fibre has been the backbone of telecommunications since the 70’s but All of a sudden it will be obsolete.

They can change the cap if they want so not an issue really.

I am disappointed in your comment you have moved from rubbery facts to fantasy.

“So basically you are saying that FttN can make more profit once it is cash flow positive this is not based on facts.”

The fact is that Scenario 6 has an IRR that is higher than any of the other scenarios and 112% more than the FTTP Scenario 1. You said this is not based on facts. Can you explain.

“The second statement not based on facts is you suggest that fibre will be obsolete in the near future that is not correct fibre has been the backbone of telecommunications since the 70′s but All of a sudden it will be obsolete.”

Please point out where I suggest :that “fibre will be obsolete in the near future… All of a sudden it will be obsolete.”

“I am disappointed in your comment you have moved from rubbery facts to fantasy.”

Rubbery facts like…”“COST $51 Billion Slightly more than mix” when the cost is $10bn more?

or fantasy like ““It is more profitable” when its IRR is 12% less?

Are you suggesting the figure I provided is incorrect?

It is my opinion that in the scheme of things it is slightly more there is a difference between opinion and facts.

You are arguing with my opinion not the fact

Secondly Revenue ≠ Profit

I suggest you look up the difference

Based on the evidence

scenario 4 has less revenue but more profit

scenario 6 has more revenue but less profit

“Based on the evidence

scenario 4 has less revenue but more profit

scenario 6 has more revenue but less profit”

Can you specify the evidence substantiating those statements?

1. Revenues are inaccurate as they should give a level playing field to all options like revenues for the 10 years after completion instead they include years where the Mix option has a larger customer base giving that option more revenue.

The most customers are added to any network in the last year as you are top speed of rollout if this was a linear rollout that would give the Mix option ~$2 billion extra in revenues and Scenario 4 ~$2 Billion less.

But they are not linear so it is likely to far more than that.

If we add to that the $1 billion in opex cheaper that Scenario 4 is we end up with ~$3 billion which means if the playing field is level then based solely on the figures provided Scenario 4 is more profitable.

Please note that this is very very conservative if we base it on a polynomial -> exponential progression which is the real case it will be much more.

“Revenues are inaccurate as they should give a level playing field to all options”

In options analysis IRR is used to level the playing field among various investment options with widely varying parameters. You should seriously read up on basic financial analysis and business analysis metrics 101 like NPV, IRR, ROI and Payback. After all, you’re second-guessing analysis put together and reviewed by some of the world’s most respected forensic financial analysts. Until you have a basic understanding of financial investment analysis, this discussion is moot.

Oh I see don’t like the answer so attack the person.

I am done speaking with you until you actually answer a question rather than try and ridicule.

Also 0.6% IRR difference for a network that does not need an upgrade 5 years later.

“Please point out where I suggest that “fibre will be obsolete in the near future… All of a sudden it will be obsolete.””

“technology becomes obsolete quickly.” (steve, Posted 13/12/2013 at 2:09 am)

LOL missed that one

“technology becomes obsolete quickly.” (steve, Posted 13/12/2013 at 2:09 am)

Nothing about fibre then? “fibre will be obsolete in the near future… All of a sudden it will be obsolete.””

Ah, so you agree that FTTN will be largely obsolete by the time the NBN is finished, meaning that while it’s cheaper for the initial rollout, you’ll then have to spend another $20+ billion upgrading it to FTTP within the decade after ‘completion’, thus completely negating any shorter term cost advantage? Of course, you’ll just hand-wave that away by saying “it’ll be cheaper to build FTTP in the future”…

“Ah, so you agree that FTTN will be largely obsolete by the time the NBN is finished”

No. I don’t agree that FTTN will be largely obsolete by the time the NBN is finished. By definition, obsolete means no longer produced or used; out of date. The NBN Co. review finds (Section 3.1.1) that the median UK household today requires a maximum download speed of 8Mbps and that only a handful of applications generate the greatest demand for bandwidth per person viz. SDTV streaming (2Mbps), HDTV streaming (5Mbps), streamed gaming (5Mbps) and 4K TV (30Mbps). It finds that taking into account improvements in compression of 9% compounded per year, even with over-the-top video and cloud computing applications, the median max. download speed requirements in 2023 will be 19Mbps and that even four-adult households with a 4K TV and three HD TVs (the top 1% of households by bandwidth demanded) would need less than 40 Mbps for all but the most intense four minutes of each month. This is consistent with just 11% of consumers in 2012 taking up plans >50Mbps. Industry feedback to the Strategic Review was sceptical of widespread mass adoption of 4K TV in Australia.

All this data, evidence and analysis indicates that NBN does not believe that 50-100Mbps FTTN will be obsolete by the time the NBN is finished, nor for upto a decade thereafter.

“meaning that while it’s cheaper for the initial rollout, you’ll then have to spend another $20+ billion upgrading it to FTTP within the decade after ‘completion’, thus completely negating any shorter term cost advantage? Of course, you’ll just hand-wave that away by saying “it’ll be cheaper to build FTTP in the future”…”

Yes. It will be cheaper to build FTTP in the future for two reasons:

1. The time value of money, which makes deferring a possible FTTP build 15 years to 2030 is $6bn cheaper at 8% discount rate or more if the discount rate is higher.

2. The value of options

There seems to be much scepticism here about whether deferring an expenditure can make it cheaper. Consider this example. You want to upgrade your car this year but don’t have the money. You have two options:

1. defer the upgrade 2 years while you save the money, or

2. take a personal loan and buy it now.

The second option is the more expensive because you have to service the loan for 2 years and pay interest on the loan in addition to the cost of the upgrade. So your decision will be determined by the degree of your need. If you really need to upgrade now, you will have to bear the additional cost, but if you know that you don’t really it right away and if you’re not sure that you will even need the upgrade after 2 years and if the price of the upgrade is trending downwards due to technology improvements and competition, you’d be better off deferring the upgrade.

Steve,

Median speed is not a good measure of speed. Many hundreds of thousands of UK residents would have very slow ADSL still. Yet businesses would need hundreds of megabits. That would set the median substantially lower than just looking at just those who have access to speeds, but don’t use them. The average speed is what is important and that is substantially higher in the UK- up around 12Mbps if I’m not mistaken, or about 35% higher. And that includes those still on dodgy DSL and satellite too. Remove them and you’d be talking closer to 20Mbps most likely. That’s the problem with statistics- you can use it to prove anything you like.

Secondly, 4K at 30Mbps??? There’s not a single consumer device that can do that yet. Let alone a single broadcast. Netflix is looking at 25Mbps 4K using H.265, but it will be FROM 25Mbps up. Sure, compression processing increases and bandwidth required for the same thing decreases….that explains perfectly why we’ve not increased from dial-up speeds….oh wait….Technology is not static and bandwidth growth has outstripped things like compression for decades. Why does the review choose that one report to decide what we’re likely to need in 2023, as compared to the other half dozen which range from slightly higher to about 10 times higher, depending on which you choose? Why be conservative in data needs when it’s been proven time and again that’s foolish?

4K TV adoption will be driven by bandwidth availability. It’s no wonder the review is sceptical of it- if the network restricts bandwidth, 4K won’t grow. People were sceptical of HDTV being mainstream too….

On your point about buying a new car or deferring it- you missed the largest unknown factor- repairs. My parents have my old car. I upgraded to a brand new one just over 3 years ago, with half loan finance, for $34K when I needed to drive 1200km a week. I worked out a few months ago, if I had kept that car, I would not only have spent $2000 more on fuel, per year (so $6k all up) but also about $5000 more on repairs compared to even the relatively high cost of servicing (European car) of my new car, thanks to a muffler replacement a radiator replacement and a new set of injectors my parents needed. That’s $11K. I’ve paid $18500 for my loan. Yep, that’s $7.5K I could’ve saved….except that doesn’t take into account the inconvenience of the several weeks overall my parents car was out of service, the twice is broke down on them and the constant stress of being worried if it would start. Not to mention it being uncomfortable and much less safe. Is that worth $7.5K? It’d be pretty close.

See, when you work on purchase cost alone, you can easily make the brand new network look very expensive. When you add in loss of opportunity costs, productivity costs and general reliability, all of a sudden, that brand new network isn’t looking so bad….that’s what the CBA is for. No doubt Ergas will attempt to minimise those positives with “overseas precedence” as much as possible.

No of course you don’t think FttN will be obsolete, it’s your policy after all…… and copper isn’t out of date?

ROFL

Also by definition (since you again cherry-pick to suit the outcome)…

verb: to become obsolete by replacing it with something new.

You don’t think fibre has superseded/replaced copper making copper obsolete…? Yes just look at all that new copper being rolled out everywhere… *rolls eyes*

Anyway back to reality instead of your tedious deflection…

Having seen you bag the real NBN for missing targets, incorrect estimations, so called budget blowouts and then providing us with a lovely link…

http://management.simplicable.com/management/new/5-definitions-of-project-failure

Now use you own link and weigh it up against the governments broadband policy April 2013…

I’d suggest using “your own gauge” the real NBNCo/FttP having done a helluva lot of ground work, is infinitely more successful than a policy which (once the “overdue” review was finally received) is a complete fuck-up beyond compare…!

And it seems pretty much everyone (even your previous FttN mates who post here) except your self and the rest of the Coalition cylopic agree…

Based on the number in the review how do you explain that a $51 Billion network takes the same time to become Cash Flow positive as a $41 Billion network.

The revenue figures provided are put in a way that give the Mix option the advantage they do not take into account the extra Opex of Copper remediation and the period of time is short to maximise the advantage of the shorter rollout.

“they do not take into account the extra Opex of Copper remediation and the period of time is short to maximise the advantage of the shorter rollout.”

Copper remediation is taken into account. See pg 88.

“The revenue figures provided are put in a way that give the Mix option the advantage”

Do you have facts rather than suppositions and speculation to support that claim? You previously claimed ”“COST $51 Billion Slightly more than mix” when the cost is $10bn more and ““It is more profitable” when its IRR is 12% less

SIGH

You did not answer the question asked do I need to ask it again? well here you go

Based on the number in the review how do you explain that a $51 Billion network takes the same time to become Cash Flow positive as a $41 Billion network.??????????????????

Please explain!

“Based on the number in the review how do you explain that a $51 Billion network takes the same time to become Cash Flow positive as a $41 Billion network.??????????????????

Please explain!”

No problem. I’ll explain this after you explain your previous statements that:

Scenario 4 “COST $51 Billion Slightly more than mix”

and

Scenario 4 “It is more profitable”

Answered both in a previous comment you have ignored that to try and avoid the question.

The fact that you refuse to answer pretty much says it all though.

Read up on financial business analysis 101

You can’t answer the question maybe you need to read.

Still faithfully trying to polish the now even duller FttN turd steve…?

:/ Amazing

Deferring upgrades saves cash now, but also deferrs improvements in productivity.

If your productivity gains are deferred, you get less money in the long term!

The same excuse you give for spending money now; can be used to argue we should upgrade sooner because we can gain efficiency and save spending dollars now!

“Deferring upgrades saves cash now, but also deferrs improvements in productivity.

If your productivity gains are deferred, you get less money in the long term!”

Okay. Please quantify with evidence the improvements in household productivity, the number of households and how this will translate into a return on the $32bn additional funding.

“The same excuse you give for spending money now; can be used to argue we should upgrade sooner because we can gain efficiency and save spending dollars now!”:

Table 4-4 shows otherwise.

And the 50% (now $20.5B) FttN investment you admitted is wasted/can’t be used for the inevitable FttP upgrade?

Shh…!

Business will save significant amounts of money being able to use FTTP

My work could save thousands of dollars per month on an NBN plan. By Thousands; I mean hundreds of thousands over the next 10 years.

Steve, it’s now quite clear the numbers produced by Malcolm’s Yachting mate JBR are 100% fudged – I suggest you read this analysis;

http://www.sortius-is-a-geek.com/fudged-numbers-abound-review/

“So essentially an independent assessment is stating that NBN Co’s books were fine, so why ignore the 2013-2016 Corporate Plan in favour of the 2012-2015 plan?

Simple, to fudge the numbers.”

— edit: deleted due to repeat and bad memory

Hate to say I told you so, but I will anyway – I TOLD YOU SO!

What a shambles this “policy” is.

HFC for business?

Well if you are a really small player…

Ever try to get a static IP on HFC?

Ever try to get a /24 on HFC?

Ever try to get a large document up through HFC in the kiddie time slot?

But one thing it will do well: It will thoroughly piss off anyone who is trying to get some serious work done in an HFC area where ADSL runs best with the modem set for G-dmt.

Make the bastards who impose this crap live in such an area before inflicting it on honest people.

Not only cancelled in HFC areas, it will be a grand total of 5% FTTN by the end of calendar year 2016.

Hilarious stuff. Hang on, you live in an HFC area, right, Renai?

Looks like an upgrade from 64QAM to 256QAM is one of the best things you can hope for.

Except that Telstra has apparently already done that, so…

> In relation to the Telstra HFC network, should Foxtel agree at some point in time to move off HFC, this would free up another ~30 8MHz channels.

> Building out the network from 750MHz to 1 GHz

Wow, this is just so desperate it’s almost beautiful.

> leading to a peak contribution per subscriber of 4-7Mbps downstream by 2019

I am in tears. I really am. BWAHAHAHAHAAAA.

“Our NBN, if we push it really hard, if Telstra cooperates and all, if we manage to free up space and upgrade it to the technical limit, will do, in the most urban areas, 4 Mbps per user guaranteed”

The increase of capital expenditure by $18 billion is apparently due to higher costs of deployment. Last I heard, in the Senate Estimates, it was apparently between $1400 and $1500, when NBN Co had been expecting $1200 this financial year. That does not account for anywhere near $18 billion.

The ‘revised outlook’ has 64,000 premises being passed between July and September 2013, yet only 130,000 between October 2013 and June 2014. Excuse me?

In FSAMs active before December 2012, the share of 100 Mbps speeds exceeds that expected by 2016 in the last corporate plan.

“Industry feedback to the Strategic Review was sceptical of widespread mass adoption of 4K TV in Australia.” There has been a $520 4k TV, delivered by Amazon, on OzBargain recently. 39 inch. Without delivery it’s barely over $400. Somehow, I think widespread mass adoption might only be a few more happenstances like this away.

“While FTTN has generally overtaken FTTP in recent years, both are losing ground relative to super-fast HFC networks, which have grown rapidly to take a 33 percent share of superfast broadband premises passed”. No, upgrading to DOCSIS 3.1 doesn’t count as new premises being passed. According to Point Topic, FTTx has surpassed HFC in Q3 2012 all up. Not only is HFC (if you look at it properly) not growing faster than FTTx, it’s actually been surpassed in absolute numbers.

I love how they’re already talking about the need to upgrade FTTN to FTTdp by 2020 too. FTTN won’t even be finished by then. Hilarious stuff.

“…the Strategic Review was sceptical of widespread mass adoption of 4K TV in Australia…” — side issue here, but I wonder if they realise how widespread the adoption of 3D TV’s has been in Australia.

Not because people want the technology, but because it comes as a default feature. In the years to come you will have the same thing happen with 4K. People may not conciously purchase them, but they will have them because they come by default.

Personally, thats no more than 5 years away, and mostly because its going to take that long for most people to get to the point they will want/need to upgrade.

Adoption of technology doesnt have to be a concious effort.

For me, whether 4K takes off or not is in the hands of the entertainment industry. You will need shows and movies available at that level for it to be relevant. As all movies are filmed at that standard or higher, its definitely out there.

As a side note, we dont actually get 1080p standard on TV anyway (best you see is 1080i, FTA or PayTV), so its going to be a hard sell to show that the 4K standard is going to be adopted locally anyway.

It doesn’t even need to take 4k TV, what about a 4k or 8k Oculus Rift? Also blows their claims about energy consumption out of the water, you can power those almost on a USB port.

I also love the bit about moving Foxtel out of the spectrum. And what’s going to happen then? You provide Foxtel over VDSL instead? That’s not a saving, that’s just reshuffling to meet a pointless number with, actually, a worse result all up.

Yup. To me, I think it can be summarised quite simply. They are trying, conciously or not, to shape our future potential, rather than overbuild and allow whatever is to come, to flourish to the best of its capabilities.

Every obstacle put in the way of the next Facebook, or blu ray, or whatever technology you care to mention, is one more obstacle stopping it from working to our benefit.

Which can never be a good thing.

And the Liberals are supposed to be the free-market “get out of the way of progress” party. Instead they wish to hinder it. Sigh. My coming down hard on the Libs looks like it’s bias, but it’s just the conclusion of thought and evidence.

Look at the entire history of the Liberals and this idea of them being about free-markets is a nonsense. Their history is one of using government to benefit the party faithful. Selective property deals have been going on for 150 years. Follow the names involved and it goes right to current members of parliament (this happens on the state level). Privatisation programs that make a fortune for consultants and advisors and have been of questionable benefit to the community. Telstra is very well connected and they are being setup for the next few decades courtesy of Malcolm.

Now we get paid parenting, restoration of the subsidy on luxury cars, abolition of the carbon tax. Everything about this government is to do with concentrating wealth in a self-entitled ruling class. Hell, Alexander Downer was using our intelligence services to perform surveillance for the interests of a private company for which he now works. In China if he was caught doing that he would be up for execution. Australia is surely open for business – selling out so some brain dead silver-spooners get to live a life of luxury while sabotaging education and ubiquitous public infrastructure that would lift everybody up.

Sorry for the rant – bloody politicians of all description have gotten to me lately.

The worse part about that quink?

1GHz HFC has been trialled in Japan and other countries. Its’ reach is limited due to having twice the attenuation loss of lower HFC frequencies. Not to mention the huge amounts of EMI produced in the Coax cable as a result, interfering with mobile & other frequencies, depending on cable shielding and construction.

Yes, it’s possible to take our HFC to 1GHz and even beyond….does that mean it’ll be easy or cheap? Nope.

For the life of me I don’t know why (well, I do- political gagging) technical experts at NBNCo. aren’t jumping up & down about Scenario 4 saying how much better it is and HFC can be upgraded as a matter of course once FTTP construction is finished. Sure, we still get nothing in HFC areas for a while….but at least the network would be uniform FTTP after 2025, instead of this ridiculous hodge-podge we’ll have for 15 years.

so you can only really guarantee what people are largely already getting on DSL? and if you are lucky you will get unguaranteed speed somewhere above that, if few enough locals are using it? this is getting past joke territory bloody quickly……

So, let’s see the assumptions and numbers behind this new “$73billion” costing. Is it like the time Malcolm Turnbull stated that FTTP would cost $94billion, by assuming the absolute worst case for everything?

I do like the point AJ made above, though – they achieve their number by effectively thumbing their noses at a third of Australia and saying “No high-speed broadband for you!”

FYI: I’m on Telstra cable at the moment due to lack of options. While I’ve seen speeds as high as 32Mbps, that was at 6am on a Sunday morning, a time when just about nobody is using the network. Early evening, especially during school holidays, it’s less than 10Mbps, and the lowest I’ve seen was just 1.5Mbps.

But, I guess 1.5Mbps still falls under “up to 50Mbps”, so they’ll call it good.

I should add:

Did anyone really expect any other outcome from this review by Malcolm’s mates?

Renai did. As someone mentioned earlier though he’s in an HFC area, so he gets nothing. Only fair IMO.

No, I thought Renai was saying “Let’s wait & see what the review says before jumping to conclusions”, which is, IMHO, a reasonable outlook. I’m guessing he probably still expected this result, though. :-)

He actually said multiple times in various comment sections that “turnbull said he would deliver” blah blah blah, always referring to rollouts in the UK or some such location and ignoring everyone else’s points about the massive differences between the rollouts there and in Australia.

Renai did. As someone mentioned earlier though he’s in an HFC area, so he gets nothing. Maybe he can pay for a special extension of fiber to his home, as he said he would be willing to do if it cost under $5000. Oh wait, you can’t extend fiber from an HFC system. Oh well.

Whoops sorry for double reply. I don’t see an edit or delete button on my ipad unfortunately.

AND FOR ALL THE CUNTS THAT VOTED FOR THIS MOB….. THANKS.

+1

Well said, my feelings exactly.

Well put, currently out in front by a country mile for the worst Aussie Gov in history!

Btw, I was watching a US comedian the other day and his definition of “a conservative” was bang on:

“A conservative is someone who is stuck in the past but wants to control your future!”

Couldn’t be more accurate IMO!

your welcome :)

life aint all about the internet (and I work on it 5 days a week on 5M adsl)

Poor you, i am also stuck on it as well, with a much worse connection than you have. But unlike you i voted for a party that wanted to move Australia forward, not reverse us back to the 1950’s

So thanks again..

BTW please see my original post for what i think of you and your ilk.

LOL, don’t look at me I voted Labor

Jesus. How much are our Internet bills going to be under the FTTN plan. With reduced income due to it being impossible to deliver a service anywhere near as capable as FTTP, I can only imagine that we’re going to be paying through the nose for our 25Mbps.

This is ridiculous. To be honest I thought the original $29bn for FTTN was ridiculous and I’ll say it again: I would rather they cancelled the NBN altogether than waste money on FTTN.

Also, I bet they haven’t accounted for the councils taking forever to approve the locations of the nodes either. FTTN is going to take longer to rollout than FTTP and cost more. The only way to justify it is to lie about how much FTTP would have cost and how long it would have taken.

Yep, Dave, that has my vote too. Cancel the bloody thing. We don’t want this ABSOLUTE shambles.

Telstra must be laughing their arses off.

agreed, I shall start writing to my council to try to fight as many node cabinets as possible

haha. do that. and your area can have satellite instead sucker!

Yep bin it; too much cash for too little benefit, especially when you factor in the monopoly powers of the NBN Co. Recipe for disaster!

I was never a fan of the ALP policy, but this is significantly worse.

The only place the government has any business rolling out infrastructure like this is in regional and remote areas where there are NO commercial offerings. Everywhere else demand will eventually lead to supply.

Remember the NBN was envisaged as a solution to a problem which by 2007 had already been solved, i.e. Telstras reluctance to allow competitors access to their pits. Once that happened we got ADSL 2+ at reasonable prices. NBN is a solution to a problem which existed in the early 2000’s and then it became a vote winning white elephant.

Either go FTTP or just bin it.

Demand never leads to enough supply in an infrastructure market, even in urban areas. The barrier to entry is just too high for more than 1 or 2 competitors.

“Everywhere else demand will eventually lead to supply.”

This is not true. A more correct statement is:

Everywhere else demand, combined with strong competition and with sufficient capital available, will lead to supply.

1) demand, in terms of raw numbers (especially vs deployment cost) is small in Australia due to our small population and the large spread of our population

2) there is little to no competition in telecommunications in Australia, due to the presence of the vertically-integrated behemoth Telstra, no one can compete with Telstra and without competition Telstra has no compulsion to advance technology rather than continuing to sweat its existing assets

3) only Telstra has enough capital in Australia, but see (2)

The simplistic statement that demand leads to supply shows that you have at best a skin-deep understanding of economics. Did you perhaps quit after year 11 high school economics?

Ultimately though I do agree with your conclusion. FTTP or bin it.

Some simple maths:

Coalition NBN, covers 70% of premises with some sort of upgrade, costs $41bn

Original NBN, covers 100% of premises with FTTP or wireless, costs $73bn

$41bn / $73bn = 56%

So for 56% of the cost you cover 70% of the premises, 32% of which are FTTN needing upgrading by approx 2025.

So, for this to be worth it, the upgrade cost from FTTN to FTTP for 32% of the premises needs to be no more than the difference for covering 70% of the premises with FTTN instead of FTTP

70% of $73bn = $51.1bn

$51.1bn – $41bn = ~$10bn

Who here believes that it will be possible to upgrade 32% of premises from FTTN to FTTP for $10bn?

This is of course a very simplistic analysis. It would be much easier if I knew the cost of covering the 7% of the population with Fixed wireless or Satellite. Also note that this is based on the “reviews” new total of $73bn. Who knows what the assumptions are for that.

edit – love the edit function :-)

Actually they published costs for a streamlined FttP network of $64 Billion

Your calculations assume the government will be deriving revenue and profit from all these different connections. Under labor’s plan the network would pay for itself. This new plan… Well who knows where the money will come from.

It’s not really “cost”, though, it’s “peak funding”…

If we break down one the earlier 2012-2015 corporate plan dated 6 August 2012 {page 71}, it’s:

Peak Funding date (rollout completion): FY2021

CapEx (FY2021) = +37.4b

Revenue (FY2021) = -23.1b

OpEx (FY2021) = +26.4b

EBITDA (FY2021) = +3.3b

Peak Funding (FY2021) = 37.4 -23.1 +26.4 +3.3 = ~44b (44.1b, accounting for rounding errors)

We need that break-down of costs and revenues in order to really make a valid comparison.

For comparison, the strategic review found that the numbers were {Exhibit 0-1; Page 12}:

Peak Funding date (rollout completion): FY2024

CapEx (FY2024) = +37.4 +18.5 = +55.9b

Revenue (FY2021) = -23.1b +13~14b = 10.1~9.1b [I include this only because, for some reason, it was the number selected in the executive summary {Page 11}; compare it to the FY2024 number below. Clearly they did everything they could to put it in a bad light.]

Revenue (FY2024) = -23.1b -1.9b = -25b

OpEx (FY2024) = +26.4b +5.4b = +31.8b

EBITDA (FY2024) = +3.3b +7.5b = +10.8b

Other = -0.8b

Peak Funding (FY2024) = 55.9b -25b +31.8b +10.8b -0.8b = ~72.7 (72.6b, accounting for rounding errors)

These numbers are dependent on the following assumptions:

– Delays in deployment

– Delays in take-up

– Lower average revenue per user (ARPU)

– Higher levels of non-subscription

These two sets of numbers are what needs to be compared.

Page 14:

”

Based on overseas experience, it is possible to radically redesign the NBN Co FTTP deployment to reduce the Cost Per Premises. The changes to deployment include changes in the delivery model, which in turn result in labour productivity improvements, different and more cost-efficient architecture and materials, and cost-efficient construction techniques. This radically redesigned FTTP deployment is estimated to cost [REDACTED] build Capital Expenditure[6][Reference REDACTED] per brownfield premises passed, representing savings of [REDACTED] per premises passed versus the Revised Outlook.

…

Construction costs for an FTTN network in Australia would be in the order of [REDACTED] per premises, including the proactive copper remediation of up to [REDACTED] percent of lines in the FTTN footprint. Upgrade paths to fibre-to-the-distribution point (FTTdp) or FTTP are possible at lower cost than building FTTP now (based on estimated present value), provided that upgrades take place five or more years in the future.

[REDACTED] HFC networks could provide high-speed broadband to ~3.4 million premises in the future by adapting and extending existing HFC infrastructure. Configuration and construction capital expenditure is estimated at [REDACTED] per premises (averaged over the entire HFC footprint) to pass and connect the HFC footprint, including capacity expansion to offer at least 50Mbps service through 2019, with 1:3 relation between upstream and downstream speed.

In the Fixed Wireless and Satellite footprint, customers are taking up NBN Co’s services faster than planned. If the current trend in take-up continues, NBN Co will need to add [REDACTED] base stations and possibly an additional satellite. Initial very high-level estimates indicate that allocating ~100,000 premises to FTTN rather than Fixed Wireless and Satellite may partly avoid the cost of these capacity expansions estimated at between $0.6 – 1.1 billion. More work is required to explore this option further.

”

Can someone please, please explain to me why these numbers are redacted? Just to make FTTN and HFC look good?

See table 4-4

If I wasn’t affected by this I’d laugh and say “Told You So”, and “Quit complaining, you voted for it”, but that would only apply to 5 readers of this website.

That readers (and indeed the publisher) of Delimiter are fully aware, there was never any chance the Liberal pre-election pledge would ever work out mathematically or technically. Today’s report just proves that.

I’d like to know more about why they are abandoning full FTTP though. It still seems highly political rather than mathematical or technical.

Of course it’s a political decision.

Tony told Malcolm to destroy the NBN, so that he’d (a) please Uncle Rupert, and (b) make his biggest competitor for leader of the Noalition into the most unpopular man in Australia.

He’s hoping the backlash is strong enough to force new elections

If the carbon price and minority government wasn’t enough this wont even come close; you’re dreaming.

Pretty much. This is a small issue in the minds of voters, and worse, it’s a small issue that’s been dragged out over a long period of time. Most people who expressed interest in the NBN but weren’t interested in technology/politics in general, don’t know how the NBN has changed over time. In fact, for most people, whoever’s in government doesn’t mean a thing to them. One of my friends didn’t even know whether Abbott or Rudd were Liberal or Labor (I’ll forgive him, though, since he may be a resident, but he’s technically a NZ citizen). More fool them.

Once this thread settles down into the usual FttN v FttH debate, we should go back and count the number of “told you so” posts :)

Told you so!

Waiting for the ridiculous justifications for this from the usual yes-men.

Turnbull promised that those people who wanted to pay for fibre from the node to the premise would be able to under the FTTN model. Now these people will not be able to get fibre at all. What a disgraceful man he is.

Yep, particularly galling for those of us who were in the 1-year FTTP rollout plan.

“Breaking News: politicians go back on pre-election promises”

How about “Turnbull lied about having a fully-costed plan, lied about providing 25Mbps to 90% of Australians by 2016, and lied about having an independent review into the NBN”

Or labor lied about the real state of the NBN

Hi Steve, (or should I say Fibroid?)

steve, you claimed you weren’t partisan. Why would you say “Labor lied” instead of “NBN Co lied” about the state of the project? Doesn’t that suggest that you are being partisan?

And what are these lies? Do tell.

steve 5/12/2013…

…”Labor are lousy at keeping promises, lousy at delivery, lousy at management, lousy at budgeting and lousy at economics i.e. lousy at government.”…

“Why would you say “Labor lied” instead of “NBN Co lied” about the state of the project?

NBN Co. is 100% government-owned. The government has ultimate power and ultimate responsibility for NBN Co. Instead it ignored and kept secret its 2011 Lazard review and conducted no reviews between 2011 and 2013, even as NBN Co. continually failed to deliver to its own KPI metrics.

“Doesn’t that suggest that you are being partisan?”

No. I expect the new government to wield ultimate power and take ultimate responsibility for NBN Co.’s failures and successes.

“And what are these lies? Do tell.”

Where do we begin? You will note that coalition policy was developed on NBN Co’s 2012 forecasts, the opposition has no power over NBN CO.

In 2010 NBN Co.forecast IRR of 7%, in Aug 2012 the forecast was 7.1%, in 2013 NBN Co. has forecast negative IRR.

In 2010 NBN Co.forecast peak funding requirements of $40.9bn, in Aug 2012 the forecast was $44.1bn, in 2013 NBN Co. has forecast $73bn.

In 2010 NBN Co.forecast revenue to FY2021 of $23.6bn, in Aug 2012 the forecast was $23.1bn, in 2013 NBN Co. has forecast $10bn.

In 2010 NBN Co.forecast construction capex of $36bn, in Aug 2012 the forecast was $36bn, in 2013 NBN Co. has forecast $56bn.

In 2010 NBN Co. released its coprorate plan to 2013. In 2012 it released an amended plan for 2013. In 2013 it failed on all KPIs in both the 2010 plan and the 2012 amended plan.

Nice copy/paste steve.

Yes, we’ve seen it all before (still no OPEL figures, since you love nostalgia though?)… I didn’t bother reading it “a g a i n” as you seem to regularly have differing conclusions/figures? Anyway…

So, now to what “embarrassingly is” (the bit you like to try to deflect from) and not what was…

You told us the new govt’s plan was superior, using BT in the UK’s apparently passing of 10m homes (which magically jumped to 16m, just two days later…lol) in 2.5 years.

It is now apparent that the UK have infinitely better management there (using your very own gauge – than the complete mismanagement we currently have in power in Canberra and at the helm of NBNCo here)… because our mismanaging mob can not achieve anything like you claimed was achievable…

So is the comparison still one you’d like to emphasise or perhaps it’s time to man-up and say you were wrong, as another “man” recently did?

Oh that’s right, you won’t correspond with me will you…. now wonder!

You will note I use the term mismanagement… it’s only because people such as yourself set the ground rules. Funny you refuse to apply the same rules now though?

:/ Amazing

“NBN Co. is 100% government-owned. The government has ultimate power and ultimate responsibility for NBN Co.

…

No. I expect the new government to wield ultimate power and take ultimate responsibility for NBN Co.’s failures and successes.”

What, like, Australia Post? I don’t think you really understand the role or position of a GBE. GBEs report to Government, Government is not involved in directly managing them. I would never trust a politician to run a GBE.

“Instead it ignored and kept secret its 2011 Lazard review and conducted no reviews between 2011 and 2013, even as NBN Co. continually failed to deliver to its own KPI metrics.”

Did it ignore them, or did it just accept the outcomes of all of the other reviews?

“Where do we begin? You will note that coalition policy was developed on NBN Co’s 2012 forecasts, the opposition has no power over NBN CO.

In 2010 NBN Co.forecast IRR of 7%, in Aug 2012 the forecast was 7.1%, in 2013 NBN Co. has forecast negative IRR.

In 2010 NBN Co.forecast peak funding requirements of $40.9bn, in Aug 2012 the forecast was $44.1bn, in 2013 NBN Co. has forecast $73bn.

In 2010 NBN Co.forecast revenue to FY2021 of $23.6bn, in Aug 2012 the forecast was $23.1bn, in 2013 NBN Co. has forecast $10bn.

In 2010 NBN Co.forecast construction capex of $36bn, in Aug 2012 the forecast was $36bn, in 2013 NBN Co. has forecast $56bn.

In 2010 NBN Co. released its coprorate plan to 2013. In 2012 it released an amended plan for 2013. In 2013 it failed on all KPIs in both the 2010 plan and the 2012 amended plan.”

So which of these are “lies” rather than forecasts?

And which of these are “Labor” rather than NBN Co?

And which of these aren’t the strategic review’s “lies”? There’s demonstrably strong bias in favour of Turnbull’s result in much of the document: it presents the previous plan in the worst possible light, it uses language that heavily echoes Turnbull statements or Coalition policy, and it uses unusual assumptions that are provided. It’s not unusual that the outcome of the review makes the previous plan look terrible and Coalition policy (with a small change in costing and delivery timeframe) look great – it was to be expected from a politically influenced review.

It’s okay to just admit that you meant to say “NBN Co” rather than “Labor”, I’m not sure why you’re pushing it so hard. Does even the strategic review talk about Labor or the Coalition? Of course it doesn’t.

For the record, I don’t consider Turnbull’s statement that everyone would have 25+Mbps by 2016 a lie – because I think he genuinely believed that it was possible due to his incompetence (if he knew that it was impossible to achieve, then it would have been another lie, though), but his other commitments are lies: a fully-costed plan which did not exist, a review that is performed by and “owned” by NBN Co, and an independent review that is very far from independent. We knew these for the lies that they were, so it’s not like we’re shocked, but all it has done is confirm what we knew. I would have liked to be wrong.

“For the record, I don’t consider Turnbull’s statement that everyone would have 25+Mbps by 2016 a lie – because I think he genuinely believed that it was possible due to his incompetence…”

+1

I think people are assuming because of Malcolm’s credentials that he is (comms) intelligent/competent.

Well being generally intelligent/competent/sly and politically manipulative and comms intelligent/competent, especially when given a clear comms direction which is anything but intelligent are completely different animals IMO…

You’re right. The lies were from NBN Co. and they were forecasts. I got carried away in the hysteria.

However forecasts of IRR that goes from 7.1% to negative in a few months, funding requirements that double, capex that almost doubles, debt that triples indicate more than simple mis-forecasting. It’s a pattern similar to the federal budget that went from a forecast surplus to $40bn deficit within 6 months .

“There’s demonstrably strong bias in favour of Turnbull’s result in much of the document:”

How can there be strong bias in favour of Turnbull’s result when Turnbull’s policy wasn’t even considered among the 6 scenarios? Please demonstrate.

“it presents the previous plan in the worst possible light”

The previous plan needs no help. It presents itself in the worst possible light relative to actual outcomes and relative to evidence from other countries.

“it uses language that heavily echoes Turnbull statements or Coalition policy, and it uses unusual assumptions that are provided.”

Examples of heavily echoing Turnbull statements or Coalition policy?

“Coalition policy (with a small change in costing and delivery timeframe) look great – it was to be expected from a politically influenced review.”

Relim, you’re getting carried away here, the coalition policy was left at the gate, it’s not even considered in the review. Since it was based on the NBN plan, it was blown away along with that plan.

“It’s okay to just admit that you meant to say “NBN Co” rather than “Labor”, I’m not sure why you’re pushing it so hard.

“You’re right. It was NBN Co. under labor’s watch.

“a fully-costed plan which did not exist”

There was a fully-costed policy (not a plan) that was based on NBN Co’s 2012 corporate plan. NBN Co. has blown apart it 2012 corporate plan, taking the coalition’s fully-costed policy with it.

“a review that is performed by and “owned” by NBN Co,”

Says so on Pg 2 under the heading Legal Notice. If this is false, it is legally actionable.

“and an independent review that is very far from independent.”

Any review that didn’t come up with the pre-determined FTTP answer would be far from independent. No evidence necessary.

I’m not going to get involved except to say steve, the Coalition plan I almost precisely scenario 6. If you can’t see beyond a few % difference in technologies between the review & their original plan, then you’ve plainly lost objectivity

IMO there was never any objectivity to start with…therein lies the problem

:/ amazing

“the Coalition plan I almost precisely scenario 6. If you can’t see beyond a few % difference in technologies between the review & their original plan, then you’ve plainly lost objectivity”

Let’s objectively compare MTM vs CP (coalition policy):

FTTP: MTM 26%, CP 22% Difference 4%

FTTN/dp/B: MTM 44%, CP 71% Difference 27%

HFC: MTM 30%, CP 0% Difference 30%

There is a 61% difference between MTM and CP. MTM introduces a technology that wasn’t in the CP.

The only few % difference in technologies is the 4% difference in FTTP.

Relim: “Coalition policy (with a small change in costing and delivery timeframe) look great”

Let’s objectively compare costing and delivery timeframes:

Peak Funding: MTM $41bn, CP $29.5bn Difference 39%

Capex: MTM $33bn, CP $22bn Difference 50%

Opex: MTM $27bn, CP $22bn Difference 23%

Revenue: MTM $18bn, CP $16bn Difference 13%

IRR: MTM 5.3% CP n/a Difference n/a

Construction: MTM 2014-20 CP 2014-19 Difference 17%

25-100Mbps 2016 MTM 43%, CP 100% Difference 56%

50-100Mbps 2019 MTM 91%, CP100% Difference 9%

Told you so.

So nothing for me, despite my HFC being all of upto 8 Mbps (thanks e-wire)

So, let me get this straight for those of us in the HFC zone:

1. We won’t get FTTH

2. We won’t get FTTN, which means also we won’t be able to “upgrade” from FTTN -> FTTH.

3. We won’t get HFC, at least for those of us who don’t ALREADY have an HFC physical connection, in apartment blocks and other places that Telstra and Optus wouldn’t or didn’t connect years ago.

4. So… we get NOTHING and no hope of anything.

Well that just made my day.

I would be betting that Optus would sell its HFC to NBN Co for a few hundred million + the $800 million they are already getting. NBN Co can then continue HFC rollout into premises that never received it initially. Telstra will not want to negogiate on this and will use its HFC + Foxtel to compete with NBN. Turnbull always wanted competition.

But then they would have to add the cost of HFC extension to their already ballooning funding numbers. Buying the networks would add billions. Keep in mind they still haven’t considered the cost of copper remediation and maintenance. There’s absolutely no way they would make themselves look even worse than they already do.

“But then they would have to add the cost of HFC extension”

They have.

“to their already ballooning funding numbers.”

… referring to the NBN’s $44bn to $73bn ballooning of course.

“Buying the networks would add billions. ”

Really?

Keep in mind they still haven’t considered the cost of copper remediation and maintenance.

They have.

“referring to the NBN’s $44bn to $73bn ballooning” — with the two numbers, what is the Government commitment within each one?

Apart from that, I’m going to be taking both numbers with a grain of salt. Both sides of this are naturally going to be presenting their own position in the best possible light, so personally I’m dubious of the $44b still.

It wont surprise me for that number to go up as time goes by. And when the Liberal review was done, its naturally going to put the Labor plan in the worst possible light, in this case making it $73b. Is there enough detail to show how they got to that number? I havent looked through closely enough to tell, but I expect they have ticked a few of the worst case scenario options they used when they came up with the $94b figure earlier in the year. Then didnt apply the same conditions to the FttN plan.

But back to the first question. What is the Government commitment in both scenarios?

“Is there enough detail to show how they got to that number? I havent looked through closely enough to tell, but I expect they have ticked a few of the worst case scenario options they used when they came up with the $94b figure earlier in the year.”

Well for starters Malcolm’s band of hired goons has ignored the 4.billion in construction savings that where identified in the now MIA version 13 of the Corporate plan – obviously they where just too inconvenient which is why it took a Herculean effort on Conroy’s part to extract admissions from TurnBull’s goons at the senate committee hearing the other day!

Frankly the depth of Turnbull’s deceit is simply breathtaking, as is his audacity to stack every major nbn position with one of his mates (including one he co-owns an expensive yacht with)!!!!!

“referring to the NBN’s $44bn to $73bn ballooning” — with the two numbers, what is the Government commitment within each one?”

As a fully-owned government entity, the government’s commitment is 100%.

“Both sides of this are naturally going to be presenting their own position in the best possible light,”

Both sides? Page 2:”The Report has been prepared by NBN Co with the benefit of expert input as follows:

Deloitte Touche Tohmatsu (Deloitte) (ABN 74 490 121 060)

The Boston Consulting Group Pty Ltd (The Boston Consulting Group) (ABN 70 007 347 131)

KordaMentha Pty Ltd”

“And when the Liberal review was done”

Liberal review? Can you substantiate your defamatory allegation that NBN Co., Deloitte, Boston Consulting and KordaMentha are organs of the Liberal party? Would you like to defend that claim in court by putting that allegation under your real name and address?

“its naturally going to put the Labor plan in the worst possible light, in this case making it $73b. Is there enough detail to show how they got to that number?”

Yes there is. Pg 35-73.

“I havent looked through closely enough to tell, but I expect they have ticked a few of the worst case scenario options they used when they came up with the $94b figure earlier in the year. Then didnt apply the same conditions to the FttN plan.”

Ah. No need to let the facts get in the way then.

“But back to the first question. What is the Government commitment in both scenarios?”

As a fully-owned government entity, the government’s commitment is 100%, it owns 100% of the company and is responsible for 100% of the funding, 100% of the risk and 100% of the blow-outs.

Actually steve, I’m not sure if you’ve read the report all the way through, but the Government is quite clear. They are only putting in $29.5 billion, regardless of the scenario. Any of the scenarios costs significantly more than that. The rest comes from private debt (not equity). Sure, the government still owns 100% of the equity, but the private debt significantly increases funding costs and risk.

On the point about consultants- Turnbull was very very specific that he was going to make this strategic review “NBNCo’s own- no consultants as the previous Government loved to spend money on”. That clearly is not the case. And there’s only one reason to bring in consultants after saying you wouldn’t- you don’t trust in or want to have the information as provided by the company direct. Either because you believe they are corrupt or hiding something or because that information doesn’t suit your agenda.

It’s up to you to sort out which reason you think is more likely for a Government who’s made it clear they don’t want this NBN, but now have to do it because it’s gone too far….

“Actually steve, I’m not sure if you’ve read the report all the way through, but the Government is quite clear. They are only putting in $29.5 billion, regardless of the scenario. Any of the scenarios costs significantly more than that. The rest comes from private debt (not equity). Sure, the government still owns 100% of the equity, but the private debt significantly increases funding costs and risk.”

I have read the report all the way through. The government is putting in $29.5 billion regardless of the scenario, which makes it more imperative that the chosen scenario must have the least requirement for additional private debt. For example, it will be hard enough to secure to secure $12bn private debt with a 5.3% IRR business case, let alone $22bn with 4.7% in the business case.

“On the point about consultants- Turnbull was very very specific that he was going to make this strategic review “NBNCo’s own- no consultants as the previous Government loved to spend money on”.

Can you link to evidence that shows MT being very very specific that he was going to make this strategic review “NBNCo’s own- no consultants as the previous Government loved to spend money on”.?

“And there’s only one reason to bring in consultants after saying you wouldn’t- you don’t trust in or want to have the information as provided by the company direct. Either because you believe they are corrupt or hiding something or because that information doesn’t suit your agenda. It’s up to you to sort out which reason you think is more likely for a Government who’s made it clear they don’t want this NBN, but now have to do it because it’s gone too far….”

It is very common, almost mandatory business management practice for the executives/owners of a company to bring in external independent consultants when a large project fails to meet its deliverables and shows any signs of deep financial stress and out-of-control expenditure. If the project was on track, there would be no reason to.

My point about the Coalition capping their contribution is that it’s out of ideology, not out of sensibility to a project & its’ impact on our economy. Why $29.5 billion? Do they have advice that is the perfect ratio of spending to benefit? As far as i can see, they chose that number off a calculator during their campaign to be re-elected. Why?

On the issue of consultanats, visit Turnbull’s blog below and look at the answer to this question:

In terms of the strategic review, why have the NBN Co priced the cost of Labor’s former plan, which you put it to around $94 billion, Labor, I think, estimated it as low as $37 billion. Why have the company look at that plan given that your policy’s very clear about fibre to the node. Is there some chance that you could review some elements…

http://www.malcolmturnbull.com.au/media/announcement-of-new-nbn-board-and-launch-of-nbn-strategic-review

Then later, Turmbull announces these firms will “assist” with the strategic review. I’ve read the review- 75% of the information and 90% of the predictions are from the consultants. Not NBNCo. Particularly that surrounding needed speeds in years to come. That is in direct contrast to NBNCo’s own Corporate Plan which stated they expect 45Mbps to be the average speed by 2021. The only info that isn’t is direct numbers from the rollout or NBNCo’s finances.

This review was done by the consultants in direct opposition to Turnbull’s insistence it would be NBNCo’s own. Exactly as many of us thought it would. Pay a consultant & they’ll give you any context you like to make the info you have reinforce your agenda.

“My point about the Coalition capping their contribution is that it’s out of ideology, not out of sensibility to a project & its’ impact on our economy. Why $29.5 billion? Do they have advice that is the perfect ratio of spending to benefit?”

Thanks seven_tech for another calm, sober response. $29.5 billion is $0.9m less than the $30.4 billion committed by Labor. Was Labor’s capping their contribution out of ideology, without regard to sensibility and its impact on the economy? After all, the project was costed as needing $44.1bn in funding. Given $29.5bn is $0.9bn short of Labor’s $30.4bn commitment, it is likely that the liberals were simply matching Labor’s commitment while delivering more quickly and without requiring NBN Co. to rely on securing private debt, which was always unlikely.

“On the issue of consultanats, visit Turnbull’s blog below and look at the answer to this question:..”

http://www.malcolmturnbull.com.au/media/announcement-of-new-nbn-board-and-launch-of-nbn-strategic-review.

The link has nothing that is “very very specific that he was going to make this strategic review “NBNCo’s own- no consultants as the previous Government loved to spend money on”. ”

He said he wanted NBN Co to own the strategic review while engaging as many experts from inside and outside the company as NBN Co. saw fit.

From the link:

“It’s really important that the directors and the management own this. They should get advice from experts, you know, inside the company, outside the company – sure. But they have got to, at the end of the day, be able to say to the Government, as shareholder, this is where we honestly, genuinely, objectively, soberly believe this project is right now. This is where it was going to go, under the previous policy, and here are some options to have a more cost-effective outcome.”

“75% of the information and 90% of the predictions are from the consultants. Not NBNCo.”

Perhaps. But NBN Co. owns the review, selected the consultants, oversaw and reviewed their work and prepared the report with their input. As it says on Pg 2 “The Report has been prepared by NBN Co with the benefit of expert input”

“This review was done by the consultants in direct opposition to Turnbull’s insistence it would be NBNCo’s own. ”

Yet to see evidence of Turnbull’s insistence that NBN Co. not engage consultants. The link you cited has him saying “They should get advice from experts, you know, inside the company, outside the company – sure. But they have got to, at the end of the day, be able to say to the Government, as shareholder, this is where we honestly, genuinely, objectively, soberly believe this project is right now. This is where it was going to go, under the previous policy, and here are some options to have a more cost-effective outcome.”

This is reflected on Page 2 of the report “The Report has been prepared by NBN Co with the benefit of expert input”

“Buying the networks would add billions. ”

This needs further discussion as it has been mentioned often. I believe it is a misconception but happy to be corrected. So here is the situation as I understand it:

1. Telstra has already signed a deal with NBN Co. with $11 billion of “net present value” i.e. $15 billion actual cost to retire its copper network, lease its ducts and transfer its customers to the NBN.

2. The government has already declared Telstra’s network and has the legal power to appropriate it for third-party access. Legislation is in place that allows the government broad discretion to structurally separate and otherwise punish Telstra if it doesn’t co-operate with the NBN.

3. NBN Co. only needs access to the last-mile copper outside of the FTTP, FTTB and HFC footprints.i.e. last-mile copper to ~30% premises, which is a small fraction of the total copper network

4. Under the current deal Telstra can’t get full earning potential from leasing to the NBN until the next decade. A new deal allows them to bring these earnings forward.

5. This combination of legal powers, already agreed upon expropriation of the copper network by NBN and earlier earnings incentives means there is very little commercial value left for Telstra in the copper network, puts NBN Co. in a strong negotiating position and makes a no-to-low-cost deal more likely than not.

Similar situation applies to the HFC networks.

Steve,

The HFC networks are not declared. Therefore, money must change hands for the Government to gain control of them. Telstra have indicated they will not accept less value for what they already negotiated (losing the copper CAN use, but retaining PayTV use of the HFC). They are unlikely to accept losing access to the HFC entirely (including PayTV) for free as “same value”. I can’t comment for Optus and their $800 million, but I believe if the Telstra agreement changes, the Optus one has to (it’s in the contract). That would suggest at least a renegotiation, if not more money to actually purchase the HFC from them (which in my eyes would be foolish- Optus’ HFC is in such a bad state in some areas they’ve simply switched it off & left it in the footprint many hundreds of thousands of premises).

HFC negotiations are not going to be simply. Neither are the upgrades. HFC in this country is nothing like the USA or Europe, but this review treats them as such. HFC here was designed for PayTV only and as such would need significant time and CAPEX to bring them to CSG data standards for business.

seven_tech, thanks for the information. I wasn’t familiar with the HFC situation as you described. The NBN cost-benefit analysis and re-negotiations will be interesting to see how this is addressed.