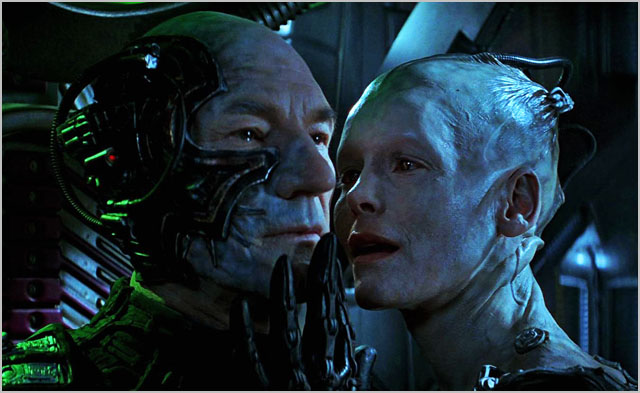

opinion You can easily imagine what coffee meetings with Michael Malone must be like these days. “Resistance is futile,” the leader of the growing iiBorg empire would sternly tell anyone brave enough to enter his company’s headquarters. “You will be assimilated. We will add your biological and technological distinctiveness to our own.”

iiNet’s rapacious and enduring interest in acquiring any major Australian ISP it can get its hands on has led to it adding dozens of scalps to its belt over the past several decades. The company’s list of successful targets reads like a list of the telecommunications industry’s developmental history. Names like RuralNet, Netlink, iHug and Origin Internet (2003), Froggy and Virtual Communities (2004), OzEmail (2005), Westnet (2008) and Netspace and AAPT (2010). And that’s not even counting the several dozen other smaller ISPs — which iiNet likes to described as ‘micro-ISPs’ — that the company has swallowed in that period.

Several of these companies have been giants of the ISP industry. The OzEmail acquisition added almost 300,000 Internet users to iiNet’s roster and catapulted it into the spot of third-largest ISP in Australia. The 2010 acquisitions of AAPT’s consumer arm and Netspace weren’t quite as large or significant, but they still had a major impact on the telecommunications landscape in Australia. But beyond this, it has been in the acquisition of smaller, typically localised regional ISPs that the true impact of iiNet’s never-ending acquisition trail has been felt.

In 1998, for example, as the Internet industry in Australia was just hitting its stripes in the first dot com book, iiNet acquired no less than 14 small ISPs. That was just five years after iiNet was founded. And those weren’t the company’s first acquisitions — those took place in 1996, just three years after iiNet was founded.

1999 was another banner year for the company, when it picked up half a dozen ISPs of a decent size. After that period iiNet had a break of a few years, before dramatically expanding again in 2003 with another tranche of acquisitions. And since that point it has never really stopped — if there is a deal to be made in ISP land, there’s no doubt that iiNet will be one of the players invited to take a seat at the table.

Now, I don’t want to imply this has broadly been a bad thing for the industry in many ways. After the explosion in small ISPs in Australia in the early 1990’s, many of those small family businesses had to be rationalised, and iiNet has gone about doing so in a very humane way. The ISP usually gently welcomes the customers of its targets into its arms by allowing them to keep their existing broadband plans, email addresses and other preferences, and it often — for example, in the case of Westnet, Netspace and AAPT — maintains the brands which they initially signed up for.

But, like the giant force of inevitability from the Star Trek universe which Australia’s technology community is increasingly associating it with, iiNet ultimately does assimilate its targets into its own very specific iiCulture. Its acquisitions’ customers are added to its databases and gradually start purchasing its products from the mothership, their networks are added to its own and integrated, and iiNet segregates out the staff it wants to keep while gently discarding the others.

The effect that this has had upon Australia’s ISP industry over the years has been dramatic. As time has gone on, many of the best technologies, employees, networks and administration systems have come to be associated with iiNet at one point or another. Like a giant swarm, iiNet has moved through the industry, sifting out the gold from the brass and making the best parts of everything its own.

If you believe the reports published this week, iiNet is in the final stages of adding one of the last jewels of the industry to its horde: TransACT.

And I do believe the rumours. Frankly, I am extremely surprised that TransACT has survived as an independent entity in Australia for this long. I’m sure Don Malone has been knocking on the company’s door for the best part of the past five years, and it’s only due to factors such as the NBN rollout, which will overbuild its infrastructure in Canberra and Victoria, making it completely obsolete, that TransACT wants to sell up.

It was only in late August this year that Shadow Communications Minister Malcolm Turnbull visited TransACT chief executive Ivan Slavich in Canberra. “So all of this investment that TransAct has made, which is delivering very high speeds currently is going to be overbuilt and as a result will deliver no better service but undermine TransAct’s business and of course cost the taxpayer a fortune,” said Turnbull at the time.

How soon after this did Don Malone move in to make Slavich an offer he couldn’t refuse? With the future value of TransACT’s business devalued due to the NBN, it sounds like it was the perfect time to put some money on the table.

Malone famously said in mid-2010 that there were at that stage only four and a half meaningful players left in Australia’s Internet service provider market. The top two – Telstra and Optus — are too big to be bought, and the next two — iiNet and TPG — have bought almost everyone else. Then there’s Internode, which, for reasons best known to owner Simon Hackett, hasn’t bought any other ISPs nor expressed any interest in being bought, although Malone probably should have included Dodo in his list instead — as it’s larger than Internode and more aggressive in the market to boot.

Now that 2011 is almost over and iiNet just keeps on swallowing Australian ISPs, I would go Malone one further.

In the next few years, it is no stretch to argue that Australia will not only have just half a dozen major ISPs — but that those ISPs will become, in any practical sense, the only ISPs operating in Australia’s broadband market.

When you look at the remaining ISPs outside the top five, the pickings are pretty woeful. Primus, probably the next largest player, has a new local chief executive but mediocre product offerings and a US parent which is only just slightly over the edge of financial oblivion and bankruptcy. Exetel, EFTel and Adam Internet are tiny companies which have struggled to make the transition from the family-oriented ISP structure of the 1990’s into the new market structure dominanted by giants, and probably don’t make much profit, if any. None have any significant infrastructure of their own to help keep bandwidth costs down.

One can argue that new players like Vodafone will enter the market and quickly gain scale with significant marketing clout. But in an environment where iiNet and TPG have already been blanketing Australians with advertising over the past few years and Telstra and Optus have been given fresh war chests by the government courtesy of their deals with NBN Co, it’s hard to see even Vodafone having too much impact.

What does all of this mean?

It means, as I pointed out in mid-2010, that there will not be a strong level of competition for customers and innovation on the National Broadband Network infrastructure which NBN Co is rolling out right now, due to the rapid disappearance of retail service providers from the market. Customers will be increasingly presented with just a handful of choices — Telstra or Optus at the top end for bundled plans, iiNet and Internode in the middle and TPG and Dodo as the cut-rate operators.

And if TPG delivers on the early threatening promise of its 4.4 percent stake in iiNet and eventually successfully makes a move on the company, which remains vulnerable on the Australian Stock Market due to a weak share price and a lack of cornerstone investors, the market will be diminished even further and Australia will be almost back to where we started — with Telstra and Optus dominating everything and a couple of other competitive options.

It’s said that Australia loves duopolies. Woolworths and Coles. Fosters and Lion Nathan. BHP and Rio Tinto. Ford and Holden. Qantas and Virgin Blue. Fairfax and News Ltd. David Jones and Myer. Liberal and Labor. Do I need to go on? It would be an absolute tragedy if the country reverted to something close to this mix in the telecommunications sector, following the rollout of the National Broadband Network.

But every time the iiBorg assimilates another ISP, that nightmare scenario gets just a little bit closer.

Image credit: Paramount (From Star Trek: The Next Generation)

The image is actually from the Star Trek film “First Contact”.

Which features the entire cast, actors, production crew, from The Next Generation :) But I take your point …

Resistance IS futile only when less than 1ohm…

*boom boom*

*groan*

In a mature industry, it is always the number 1 and 2 that take the largest chunk of business/profit. The rest are just fighting for survival. This is the same for almost all industrial. it is a natural evolution.

Why ISP should be any different?

Internode and Dodo are hard to compare given their respective privately owned status.

Just personally though, while Dodo may have more customers overall, I think Internode would be larger given their bigger standing in the business and enterprise space.

I’d humbly suggest Internode are likely to have a healthier client base over DoDo, Renai.

iiNet’s business model is to take over other ISPs. Internode’s business model is to be a little bit better (service, value add, etc) than everyone else. It maintains a degree of choice, which as I have always maintained, is a good thing.

There should be more than just one or two retailers, with respect to the NBN, or we’ll end up with an effective duopoly or oligopoly, which (based on every market that ever occurs in) typically doesn’t end well for the consumer.

“I’d humbly suggest Internode are likely to have a healthier client base over DoDo, Renai.

Why do Internode clients have more regular blood pressure checks and exercise more than other ISP cuistomers?

:)

No, Alain.

I was referring more to the hosting and business facing products Internode provide. Something that isn’t reflected necessarily in straight customer count.

How many businesses do you know, that use DoDo, alain? I don’t know of any – but I *do* know of quite a few using Internode.

Well you summed it up quite nicely, ‘ you don’t know of any’ – enough said.

I think there will be a reduction in the amount of competition regardless of whether the NBN gets rolled out or we end up on Turnbulls hotch potch FTTN solution. For example, FTTN will see the proliferation of thousands of nodes around the country. To compete on an FTTN network, an ISP must either by capacity or install their own hardware at every one of these nodes. Today, we see the lack of investment in DSLAMs outside selected areas, and there are only a few hundred nodes (exchanges). The argument from ISPs is they cant afford to be in every exchange. This is only going to get worse when they will be expected to kit out thousands of nodes. This is not taking into account things like increased backhaul etc.

Bottom line is that consolidation has been a trend in the sector for a long time, well before the NBN, as your article highlights. What we are seeing now is it heading to its logical end game.

Not True.

FTTN offers an opportunity for enhanced competition and infrastructure sharing.

FTTP will restrict Access Seekers to mostly purchasing network connections from NBNCo in the form of CVC for example, with little independence in regards to having separate and privately own hardware, be it network equipment or cables.

FTTN can be designed in various arrangments, it depends on how the space inside the Node itself will be regulated. For instance, a Node may have capacity for 24 Network cards. Since the Node is not owned by a single retailer in the market, a similar scenario in terms of providing of DSL ports at selected areas can be achieved by ISPs leasing a slot in the Node itself (similar to TEBA arrangement, ie. ISPs installing DSLAMS in Telstra exchanges).

As such, an ISP or a consortium of ISPs could install DSL ports in selected Nodes based on their needs, or they could wholesale it to other ISPs. All the while they maintain control of the port.

If FTTN is not built by Telstra, such a system can be created, as such it would be cost the ISP significantly less to provide the service.

Not True

FTTN represents a complete waste of both time and money and vast abuse of the taxpayers trust

Wow Chas could you back off on the detail a bit, it’s overwhelming.

Just responding in kind mate…though I admit to a much reduced degree of verbosity…:)

Very nicely, factually and succinctly put Chas…!

@Chas

Yeah I liked the bit about the ‘abuse of taxpayer trust’ being directly linked to FTTN but you magically put a H at the end as in ‘FTTH’ and all of sudden bingo all taxpayers are deliriously happy.

Wow it’s all so simple.

Actually, if you put an H at the end, it becomes FTTNH (don’t know what that is actually…).

But you’re right that our language is a miraculous thing. People create, debate, invent, and basically have lots of FUN! But then The Australian and the Libs come along and change that one letter at the end to a “D”, and it becomes a nightmare…

Well we could all apply the ‘Chas method’ of discussion which you label as informed debate.

The Labor NBN sucks.

There you go that was easy

You could… but Chas would still be correct and you wrong!

Actually, I did NOT label it as informed debate, I said I was responding in kind…

@Chas,

You are 100% right mate, it is so simple even a child could understand it. But alas gauging the children here, who keep intentionally forgetting and/or telling politically motivated BS, that’s not always the case…

FTTN = NO REFUNDABLE IDEOLOGICAL PAY OUTS OF TAXPAYER MONIES to private enterprise, to own and run our nations comms.

FTTP (current NBN) = FULLY REFUNDABLE (and then some).

And they have the gall and dishonesty to suggest the NBN a tax payer impost?

Don’t forget with a FTTN patchwork it’s not just taxpayers that get screwed it’s customers as well.

“…iiNet is in the final stages of adding one of the last jewels of the industry to its horde”.

That’s either an amazing mixed metaphor or a great typo. Whichever it is, I tip my hat to you sir.

iiNet has nothing, until it buys TPG.

What would be the sales pitch? “We offer really low price unlimited plans and have a attracted the every leech in Australia who download terabytes a month, want em?”, “Umm, no”

I think TPG actually have alot of very nice things for anyone looking at aquisitions, iiNet’s strong point is customers but TPG’s strong point is certainly their infrastructure.

iiNet don’t have much infrastructure and I feel it is going to bite them eventually, but regardless, I think TPG’s strong points are:

* Second (?) or third largest metro Fiber network, I seem to recall a old quote that TPG/PIPE had their own Fiber to 75% of their exchanges – and were expanding their network massively thanks primarily to deals with Vodafone and some other gov companies. This would also inevitably be Fiber to many POI’s if the NBN survives long enough.

* Huge amount of corporate customers – iiNet don’t seem to deal with corporate at the moment.

* Tied with iiNet for number of DSLAM’s

* Internet peering exchanges in SA, VIC, NSW, ACT, NSW, QLD

* Datacenters in TAS, SA, NSW, VIC, ACT, QLD, several in QLD NSW VIC

* Most advanced voice network – present in 65 of the 66 CCA’s

* International cable to Guam, providing the fastest route into Tokyo.

* Millions of ipv4 addresses, these are solid gold these days.

But personally I don’t think iiNet has the cash to buy TPG

“But personally I don’t think iiNet has the cash to buy TPG”

True, they are too big. Maybe once they absorb all the small ISPs they will be big enough to go after bigger game. Personally I hope not, they seem a very profit driven company and having been moved onto them from Netspace, where they screwed a lot of peoples connections, I have to say they did f all to try and remedy the situation. I found their customer service terrible. At least with Netspace, once you waited the 45mins wait time you got someone who had a clue.

I thought the NBN was going to enhance competition where we get rid of that ‘horrible’ Telstra Wholesale monopoly to a more friendly open NBN where everyone is on a more level playing field.

Oh well it sounded good at the time, like most Labor NBN rhetoric.

Sorry, I missed the bit where Labor or NBN Co wanted iiNet to buy up other ISPs. Could you post a link?

why isnt the accc stopping iinet doing this anti competitive behaviour,

Because iinet not a monopoly (or even a majority marketshare). This is just business…and it may be (and probably is) that those companies WANT to be bought out.

iinet is still stopping competition though, by buying the competitors out there is less competition

the accc stands for Australian Competition and Consumer Commission

so where is the competition for consumers if iinet is allowed to but them out

Well if it was Telstra or Optus doing the buying they probably would, there is a enormous chasm between the top two and the rest, and I mean total market share of communications products not just fixed line BB.

Umm, if it’s anti-competitive the ACCC will surely not allow it? Simple.

But I find it interesting that some (not you Jason) who have cried, NBN shouldn’t be governmentally owned, let business conduct business… are now sobbing when businesses are conducting business (more contradictions…sigh)

Ever hear of M & A’s?

Seems a few of them who are Telstra fanbois (again not aimed at you Jason) are starting to feel the heat!

You are like a sports fan that assumes that if the rules are fair, then all games must end in a tie.

A level playing field doesn’t mean that all companies compete the same, it means that they no longer have an unfair advantage from the monopoly. The rest is just business…

This is “private industry doing it better”. Extrapolate from here what this means for the Liberal “let private industry do it all” wet-dream broadband policy.

Why is this scenario a problem? The right-wing is always harping on about free markets and low regulation.

LOL TURNBULL.

“And what this underlines is that right here in Canberra, the Government has got an example of a telecommunications company, a private sector company that is delivering high speed broadband but doing so in a cost effective way.”

“And it’s, of course, the most affordable solution.”

“And on that question of affordability, the biggest barrier to access to the internet is the lack of household income. Most Australians who do not access the internet are in households earning $40,000 or less. So you would think one of the biggest objectives of any national broadband policy would be to make internet access more affordable.”

This is too good, talking praise about TransACT, I assume he has not looked at the prices.

Low usage: Slowest $40 + 10GB $10

High usage: Fastest $119 + 1TB $100

Comparison (NBN):

Low usage: $39,5 for 12Mbps and 20GB (Exetel) or 40GB (Optus) if you have phone bundled.

High usage: iiNet 1TB $99

Think I know which one I’d prefer…

Internode a Mid-range RSP? Are you serious? I would really call them a “top end” supplier.

It’s more referring to Price as opposed to other forms of ‘value’

I believe it’s referring to marketshare actually…

“iiNet and Internode in the middle and TPG and Dodo as the cut-rate operators.”

Renai can’t simply be referring to market share, how would TPG fit into the low end category?

“Renai can’t simply be referring to market share, how would TPG fit into the low end category?”

Fair point…

I notice that he does that all the time, lots of sites do, they often call Telstra and Optus high end, or top tier while talking about quality, and its simply not the case.

The only providers I have ever had which I can say were high end in terms of quality was Westnet before being bought and Internode, I’m sure there are more, but they are the only ones where I ever noticed how solid their performance was.

Telstra is mid-range at best, iinet I’m not sure sure about, but they are at least upper mid from what I can gather and the few times I used them.

“It would be an absolute tragedy if the country reverted to something close to this mix in the telecommunications sector, ”

Indeed it would. But isn’t this the natural progression of the free market economy? Are you suggesting that things would/could be different under a non-NBN environment?

Sure we had lots a very small independent ISP’s. All surviving under the overarching monopoly and subsequent terms and conditions of the wholesale supplier – Telstra.

Sorry Renai, but this opinion piece strikes me as a mish-mash of half baked ideological ruminations with little regard to the real world. If you really want to ensure healthy competition I suggest you cast your net a little wider. Or will you just advocate a ban on takeovers of ISPs ?

Given that the purchases by iiNet have been made, as you say, “past several decades” [though decade+ might be more accurate] I think the attempt to bring the NBN into the discussion is somewhat tenuous.

If we where a few million homes into the NBN roll-out and ISP’s where merging like mad I’d give it credence.

But the lack of any real NBN relevance, and the lack of any NBN analysis [How about new players – e.g. Woolworths? What about non-internet services? What about potential specialty services? How about the fact that 3~4 serious players is vastly better than the 1 player many Australia’s have today?] means that this could easily confuse those less aware of the underlying irony.

—–

Disclaimer aside, I get your point and I give you brownies for the star trek reference :)

“But the lack of any real NBN relevance, and the lack of any NBN analysis”

ReallY? – you either didn’t read this bit or are ignoring it from the lead article from Renai.

“and it’s only due to factors such as the NBN rollout, which will overbuild its infrastructure in Canberra and Victoria, making it completely obsolete, that TransACT wants to sell up.”

Where is the accc , why are they allowing this anti competition practice from iinet

What is anti-competitive about two companies coming to a financial AGREEMENT for one to purchase the other?

Even together they make up not even 10% of the market.

heres a bit off the accc site

http://www.accc.gov.au/content/index.phtml/itemId/816373

Anti-competitive conduct

Part IV of the Competition and Consumer Act 2010 (the Act) prohibits various anti-competitive practices that limit or prevent competition. It aims to foster the competitive environment necessary to give consumers diversity of choice in price, quality and service for goods and services. For example, Part IV prohibits specified cartel conduct and other forms of conduct among competitors that substantially lessens competition in a market. A reduction in competition that may occur as a result of the collusion might allow some traders to push prices up and lower the quality of the goods and services they offer to consumers.

Some anti-competitive conduct is prohibited on the basis that it has particular anti-competitive purposes or effects (i.e. cartel conduct such as price fixing or bid rigging), while other conduct is prohibited if it substantially lessens competition. A substantial lessening of competition may occur, for instance, when the ability of buyers to shop around for a deal that suits them is significantly diminished by an anti-competitive agreement among suppliers.

Is iinet going to allow westnet, and the other companies it brought out to under cut iinet prices

I wonder if the call centre has indicators on the screen where the same operator answers ‘Hello AAPT’, ‘Hello Netspace’ , depending on the incoming call number. lol

The point about buying out or merging of ISP’s is that every time one more ISP is lost as a separate name brand with their own management and pricing plans it is one less competitor on the market that a consumer has to choose from.

If you look at the companies post iiNet buyout such as WestNet , Netspace and AAPT you find their plans are a virtual mirror of the parent company iiNet plans on price and quota, they exist as different ISP’s by name only, they don’t have to ‘compete’ with each other anymore, you might as well call them iiNet 1, iiNet 2 etc.

Also each buyout puts increasing pressure on the medium to small ISP’s that are left who are looking at the NBN world with some trepidation where everyone sells the same bog standard NBN plans from the same bog standard NBN price book as everyone else.

The likes of BigPond, Optus and iiNet purchase wholesale NBN at that same price level as them as well and are big enough because they have enough of their own infrastructure outside the exchange to become NBN resellers with wholesale packages.

Those ISP’s entering the NBN scene with the largest client bases are most likely going to not only retain it but add to it quite easily, there is no more taking the No 1 BigPond on with your own DSLAM plans with its controlled internal cost base and selling Naked DSL based on dirt cheap Telstra Wholesale ULL pricing.

The NBN was marketed as a open wholesale access regime that would treat all ISP’s on a more level playing field, it seems the level playing field is turning into a leveling playing field.

What iiNet do could be considered Monopolistic Competition, as they own multiple different brands all offering services with very little differentiation.

The only problem is that this term is more intended for those sectors where there’s only one or two corporations with a million different brands ie. shampoo products.

The fact that there are many other competitors means that while there is ‘some’ impact on competition post-buyout, by and large many of the competitive pressures that were there pre-buyout are still there.

Think about it this way, how much effect did Netspace and Westnet really have on competition? Some, but not as much as many are giving them credit for.

“What iiNet do could be considered Monopolistic Competition, as they own multiple different brands all offering services with very little differentiation.”

Actually, it’s far closer to an oligopoly. A small number of suppliers with little/ no differentiation in the market place.

Something Paul Budde seems to want. Why, I don’t know – it’s not a consumer friendly outcome. It also typically reinforces any monopoly at play. I can’t say I am in agreement.

Evolution and progress in the market place needs differential competition. We’ve seen that with infrastructure based competition, even will all the pitfalls associated.

Telstra has the monopoly. By a considerable percentage.

All of the industry must compete within the Trade Practices Act, however. And it’s typically that Act that the ACCC work to. Granted, there are various regulations at play, but the TPA is the one typically upheld.

“What iiNet do could be considered Monopolistic Competition”

LOL – take a Bex. Don’t let the facts get in the way of a ‘big fat claim’.

With less than 15% of the market, iiNet is a bloody long way from Monopolistic.

If you check the TIO’s figures, they claim 1,214 members (p53 ann rep) so there is still a fair way to go before we become ‘monopolistic’.

It is competition, though, I’ll grant you that snippet.

But… What do you suggest?

That the companies that put themselves on the market shouldn’t be allowed to do so ?

That they should keep trading, losing market share until they disappear off the scene ?

That they should be allowed to be sold, but not to iiNet ?

S

Hey Steve,

I would agree with you that iiNet is not a monopolist — far from it.

However, clearly, by acquiring a large number of other competing companies in the Australian Internet access market over the past several decades, you are contributing to the decline of competition — and undercutting the argument that the NBN rollout will increase competition.

I would ask you to apply the same questions to iiNet that you are applying to others.

As TPG clearly demonstrated a few weeks ago, iiNet is clearly ‘on the market’ itself in that its shares are for open sale.

So could you answer me these questions:

If TPG or Optus made a bid for iiNet, should the ACCC allow them to do so?

If not, is there any other party in the telecommunications market which it would be acceptable for iiNet to be sold to?

What would be the impact on competition in Australia if TPG or Optus was allowed to buy iiNet?

What would iiNet’s reaction be if an offer was made for the company at a premium of 30 percent to the current share price?

Renai

Most of those questions are better directed to the CEO or Board, but I’ll see what I can offer.

>> iiNet is clearly ‘on the market’ itself

I disagree. Our shares are available for sale on the market, and have been since we floated, but that doesn’t mean the company as a whole is ‘for sale’. Pedantic – possibly, but I think there is a huge difference. We love what we do and want to keep on doing it.

>>If TPG or Optus made a bid for iiNet, should the ACCC allow them to do so?

I won’t speak for the ACCC. They have informally indicated in the past, however, that 20% market share is a reasonable point for simply having a look at it. They will make their own decision on whether or not any merger results in reduced competition or is contrary to the public interest, based on a range of complex questions (my words, not theirs).

>>What would be the impact on competition in Australia if TPG or Optus was allowed to buy iiNet?

I love these hypotheticals! I think we have been the epitome of competition in Australia, we innovate, we changed the shape of dial-up and then broadband with our pricing policies and our own DSLAMs, we introduced a quality VoIP offering to the masses, drove ‘Naked’, built a better modem in BoB, challenged Telstra’s wholesale pricing, reduced costs for the industry, introduced IPTV, put customer satisfaction at the centre of everything and contributed significantly to the public debate about copyright infringements, filtering, NBN applications, the digital economy and regulation.

TPG could probably see all that activity as unnecessary cost and strip it out.

Optus could possibly focus on our customer base as a source of mobile broadband prospects.

Who knows?

>> … is there any other party in the telecommunications market which it would be acceptable for iiNet to be sold to?

That is a question for the shareholders. It’s an open market. For my own personal shareholding, I’d think someone making a $10.00 a share offer would be acceptable.

>>What would iiNet’s reaction be if an offer was made for the company at a premium of 30 percent to the current share price?

That’s a matter for the Board and individual shareholders, as is the normal practice.

I don’t think 30% would be enough to sway me personally.

Hi Steve,

I agree, you are far from a monopolist.

I was simply saying that while your actions may be considered to fit that description in theory, in reality though, the market is pretty much just as competitive as it was pre-takeover.

“The fact that there are many other competitors means that while there is ‘some’ impact on competition post-buyout, by and large many of the competitive pressures that were there pre-buyout are still there.

Think about it this way, how much effect did Netspace and Westnet really have on competition? Some, but not as much as many are giving them credit for.”

I actually support your actions FWIW

I’ve been with iinet for some 10 years now (ok.. after they bought up dingoblue lol).

Can’t say there’s been much reason to complain.. ever.

When I shifted in to a new area there was no fast internet and of course Telstra was using it’s clout to block all attempts to add an iinet DSLAM and I could have gone to telstra but I hung out for a few weeks on dail-up speeds and iinet managed to get the DSLAM in anyway.

Right now I could get ADSL2 but ADSL1 is plenty fast and 200+200gb is more than enough with 5 teenagers.

NBN? I’m not going to go for that if telstra is involved, they’ll manage to screw it up somewhere.

I see NBN as the perfect carrier for a fox-style limited broadband, fully controlled by CONroy and his socialist cronies who want to control what you can get and what you get to download anyway.

>>you are contributing to the decline of competition

Sorry, missed this one which I took exception to.

It’s just the opposite. We are strengthening competition. Where companies are in decline and unable to compete, or unable to invest in their brands and continue to compete in the face of bundling, content, added value like VoIP, Freezone, and so on, they are not putting pressure on those with market power and are extracting high charges for limited products (256kbps ? 500MB quota ? charging by the MB ?).

By increasing our scale we have been able to justify investment in infrastructure, new services, improved tools to improve customer satisfaction and are able to punch above our weight in negotiations with major suppliers.

We are not contributing to the decline in competition, we may have reducing the quantity of brands in the market but we significantly improving the quality. That improvement is easily visible.

S

We need more big players, but something like 7, not 2 or 3.

Example Coles and Woolworths – only just lately going on wars for milk bread etc, before that and for other products it’s like picking between losing the left or right eye.

Comments are closed.