news The revenues of Apple’s Australian division have finally stopped their massive annual growth initiated in 2009, as the company’s lack of new product lines over the past year have stalled its onwards financial march.

If you examine Apple’s Australian financial results for the past half-decade (as disclosed to the Australian Securities and Investments Commission), it’s clear that the company’s launch of innovative new product lines such as the iPhone, iPad and new versions of its iPod, MacBook and iMac lines, as well as subsidiary products such as its iTunes app and music stores, have had upon its business.

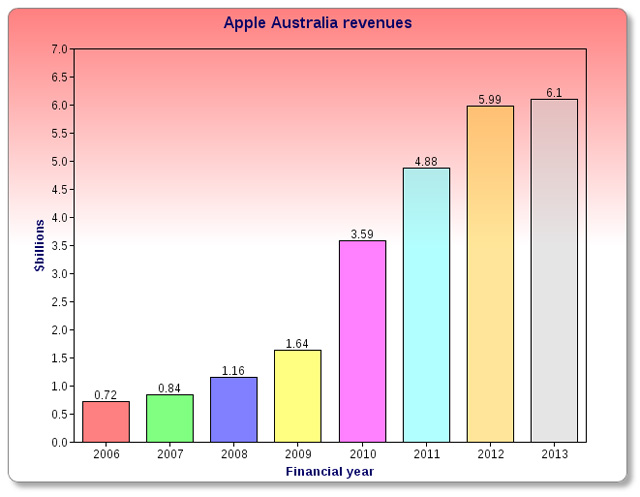

In 2006 in Australia, Apple was making less than a billion dollars in local revenue. However, the company then grew steadily throughout the next several years, and saw a substantial jump in 2010 after the first iPad was launched. In 2012, Apple’s Australian revenues hit a record high of $6 billion after continual growth over the four years previously.

However, the company’s financial results for the year to 28 September 13, released yesterday to ASIC, show the company failed to make much financial headway through the end of 2012 and most of 2013. In that period, the company’s local revenues only grew modestly to $6.1 billion. Its gross profits increased 7.4 percent to $529.4 million, while its net profit sank a little to $52 million.

Apple increased its Australian headcount a little over the 12 months to the end of September. In 2011 it had 1,505 staff, but at the end of September 2012 that figure had jumped to 2,418. It is believed that the massive jump in headcount was primarily due to the ongoing expansion of Apple’s own retail stores around Australia, with the company rapidly adding new stores in a range of diverse locations throughout the nation over the past several years. In 2013, however, Apple’s headcount only jumped a little to 2,771.

The company continued to pay only a small amount of tax in Australia, listing its local corporate income tax expense as $36 million for the period, despite the fact that it made $6.1 billion in revenues. The reason Apple pays so little tax in Australia is that as a proportion of revenues, Apple’s cost of goods sold in Australia is significantly higher as listed in its ASIC documents than it is globally, meaning the company pays little tax in Australia compared with its global tax situation.

Corporations such as Apple and Google, which make huge sums of money from sales in Australia but have not historically paid tax sums commensurate with those revenues, have been under the microscope recently. The Labor Federal Government had planned a raft of tax reform measures to deal with corporations that the Australian Taxation Office suspected were not dealing at proper arm’s length terms with their foreign associated entities.

Globally, Apple has been criticised by some commentators for what some have seen as a lack of innovation in its product lines that has led to perceived stagnation.

For example, the company’s main smartphone rival Samsung has, for several years now, offered smartphones with larger screen sizes which have been snapped up in droves by consumers. In comparison, Apple has maintained its screen size at an easier size for consumers to hold in one hand. Similarly, Apple has not released product lines in other categories, with its last major product category expansion being the launch of the iPad in mid-2010. Instead, it has iterated within its existing product lines.

Despite this issue, Apple continues to be one of the highest valued and most profitable corporations in the world. In Australia, its revenues mean it is larger than almost every technology company operating locally, with the exception of several telcos such as Telstra and Optus.

Earlier this week, the company announced record global financial results for the past six months. MacRumors reported: “Apple sold a record 51 million iPhones in the quarter, up from 47.8 million in the same time period last year, and the company has now sold 472.3 million smartphones in total. It sold 26 million iPads, a new record, up from 22.86 million last year. Apple has now sold 195 million tablets. It sold 4.8 million Macs during the quarter, compared to 4.06 million in the year-ago period.”

opinion/analysis

Don’t listen to the critics. Apple is still doing very well. But the Federal Government should force it to start paying a reasonable amount of tax in Australia.

Image credit: Apple

I’d be pretty happy if I could increase my revenue by 100 million dollars….

As would I ;)

“Apple has been criticised by some commentators for what some have seen as a lack of innovation in its product lines that has led to perceived stagnation”

Meanwhile only yesterday “IT PRO” gave the new Mac Pro 5 starts and the ITPRO Innovation Award.

There are a lot of commentators. Some of them think that putting a larger screen on a larger phone is a great innovation, but that putting the first 64 bit application processor in a phone, without reducing it’s battery life, isn’t innovative at all.

What can you do?

The typical person has no idea what sort of advance moving to 64 bit and the new co-processor is.

But a bigger screen? Even my 2 year old can tell you which has a bigger screen. Perhaps we should see it is a reflection on the commentators….

“Its gross profits increased 7.4 percent to $529.4 million, while its net profit sank a little to $52 million.”

There is only one way this is possible and it is called transfer pricing. One day the ATO will work out how to pin these companies down (or the government could just legislate) and when they do I will join in giving them a collective big middle finger. I’ve already cancelled my Google business accounts and switched elsewhere because of their attitude to doing business here in regards to paying tax. If you count stamp duty I’ve personally paid more tax than Google Australia has in total and my revenues are so small as to not even be comparable. I realise that is only a token gesture but it has to start somewhere.

Comments are closed.