news The National Australia Bank has given itself less than three years to complete its long-running, Oracle-based core banking systems replacement, with the project being the major piece of work still lagging in its total business technology transformation program, which has been under way since 2008/2009.

The bank first announced its plans to modernise its core IT systems back in August 2008. At that time it was only the second major bank in Australia to commit to such a project, after the Commonwealth Bank of Australia allocated some $580 million to its own overhaul a few months earlier. But where CommBank at that stage dove straight into its SAP-based revamp with a vengeance, NAB took a different path, choosing a lengthy co-development effort with Oracle which is seeing the bank assist Oracle in constructing a total banking technology solution which it will be able to take to the rest of the financial services sector.

In August last year, Oracle formally launched some of the final pieces of that core banking solution, and NAB announced it had finally migrated its UBank online brand onto the new Oracle-based core platform, in a move which the bank said would deliver both the bank and its 300,000 UBank customers significant immediate benefits from the new technology.

Several weeks ago, the bank held a wide-ranging briefing on its technology roadmap in the coming next few years. In an explanatory document associated with the briefing (PDF), the bank noted that its next step this year would be to deploy extra capability to the UBank platform — including the origination process, and UBank services such as mortgages, personal loans, insurance, debit cards and small business deposits.

After that, the next step in 2014 will be to migrate NAB’s consumer customers onto the Oracle platform — ranging from mortgage customers to its mobile site, to those customers with personal loans and more. This migration will likely represent the first real test for the Oracle platform at scale in a real-world deployment; NAB is the first bank globally to deploy the platform, and its UBank brand is only a minor part of its overall business.

Then, by 2016, the bank noted in its documents, it would migrate its business customers across to the Oracle platform.

Even at this stage, the Oracle platform will still be integrated into NAB’s wider legacy IT systems. However, the bank stated in its documents that after 2016, it would be decommissioning “any remaining legacy systems”, with the Oracle platform to finally stand on its own as Australia’s second major core banking systems replacement, following CommBank’s own effort over the past several years.

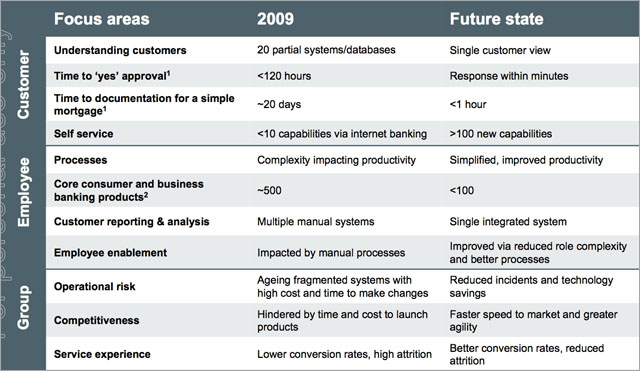

NAB has a very clear view of what this so-called ‘NextGen’ platform will deliver it. The following table illustrates its capabilities in 2009, when it started its migration planning, and thefuture state which it plans to migrate to.

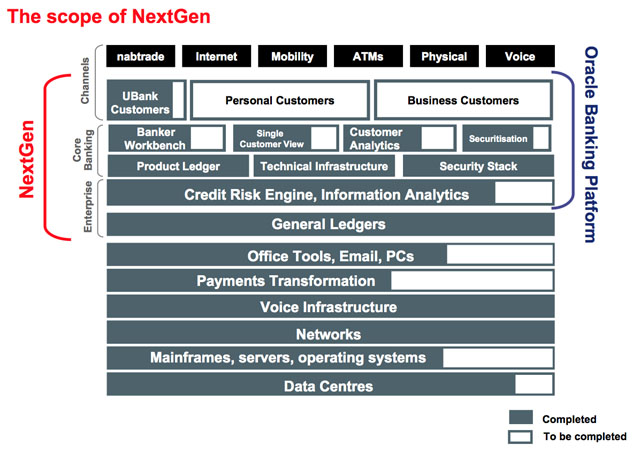

However, the core systems migration is only one part of the bank’s wider NextGen project, which taken as a total, constitutes a total enterprise IT transformation across virtually every technology category inside the bank over the past several years.

When the bank started the project back in 2009, it had nine hard-wired, phone-based voice systems, eight bespoke data networks, only 80 percent of its desktop PC fleet was less than three years old, it had fragmented operating systems, hosting and storage, as well as an “ad-hoc patching regime” on its mainframes and servers, and over 20 datacentres spread all over the place.

Since that time, the bank said in its recent briefing documents, it had upgraded its voice infrastructure to a single, web-based virtualised platform (with the help of Dimension Data and Telstra), it had implemented a single Australia-wise MPLS data network (Telstra), it had replaced much of its desktop PC fleet so that 94 percent of the fleet was now less than three years old (with the assistance of IBM), it had implemented a standard private cloud infrastructure as part of a new seven-year agreement with IBM, it had implemented a mature patching regime, and it had completed building a new world-class datacentre (IBM, Telstra and Digital Realty).

Not all of these initiatives are complete — for instance, the bank only started deploying a modern operating system — Windows 7 — to its tens of thousands of desktop PCs in November late year. In addition, it isn’t scheduled to finish migrating its applications from its current secondary datacentre to its new datacentre until the end of 2014, and it’s still migrating applications to its internal private cloud. However, as the following diagram illustrates, the bank has undertaken a large sledload of upgrades and replacements since 2009.

In an associated statement (PDF), NAB group chief executive Cameron Clyne praised the bank’s progress on its NextGen initiative. “Since 2009 we have made the hard but right decisions to deliver a more balanced and sustainable Australian franchise with greater balance sheet strength, a stronger reputation and improved productivity,” Clyne said. “Our total technology transformation program is progressing well with the core infrastructure upgrade nearing completion and NextGen well advanced.”

“The opportunities created by this investment in technology enable us to align our business structure to the changing environment and changing customer behaviours. In a digitised world, we need to ensure we can meet the future needs of our customers regardless of when, how and where they choose to deal with us.”

“The changes announced today, combined with continued investment in the business of over $1 billion per annum, will reduce complexity and duplication across NAB, provide a better, simpler and easier-to-access product suite, provide more straight-through processing as well as ensure the more effective use of data and analytics to provide the right solutions for customers at the right time,” Clyne said.

opinion/analysis

NAB’s NextGen program hasn’t been without its hiccups — and I doubt that the bank expected that some of its components would take as long as they have. However, I have to say that it is extremely rare that you see this kind of total technology transformation in an Australian enterprise. I personally can’t think of an example where so many systems have been transformed in so dramatic a manner. Perhaps the closest examples I can think of would be the Commonwealth Bank’s own core banking overhaul program, as well as the ongoing integration effort as the new Federal super-department, the Department of Human Services.

It’s a credit to the bank’s technology team — especially its former CIO and current transformation leader Adam Bennett, outgoing Group Business Services chief Gavin Slater and chief technology officer Denis McGee — to have pulled off this kind of project, and I have no doubt that it will be one glowing jewel in the crown of their long-running and successful careers — providing the last dash across the line all goes well ;)

I guess you could add Westpac’s CS90 (early 1990’s) into the same “total technology transformation ” basket as CommBank and NAB, but then again I’m not sure you could call CS90 any sort of a success.

A cynic would say that this so called “total technology transformation” is just nab spin to justify their enormous NextGen cost blow out, which hasn’t delivered anything significant. All companies periodically upgrade infrastructure, shift servers around data centres & replace phone systems. It’s hardly revolutionary and it’s deceptive of nab to claim that this is all part of NextGen’s deliverables. If nab customers aren’t moving to NextGen until 2014 then that’s at least a 3 year slippage in their schedule!

Comments are closed.