There are only “four and a half” meaningful players left in Australia’s internet service provider market, iiNet supremo Michael Malone said today — with companies like Primus, Eftel and others just not relevant any more in terms of providing competition.

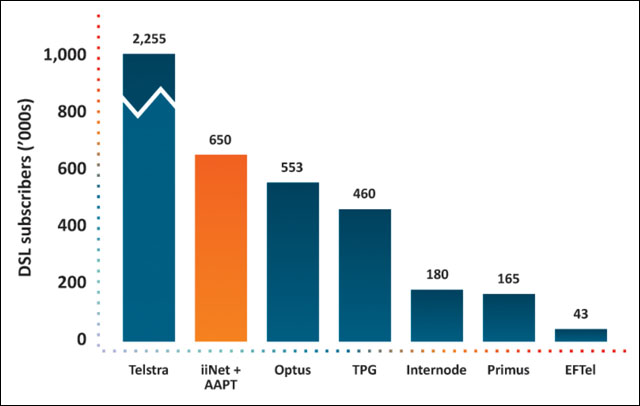

As it revealed its annual financial results today, iiNet displayed the chart above, illustrating how the market had consolidated to just a handful of players — with former competitors like Westnet, Netspace and recently AAPT having been snapped up by iiNet and others having merged or been acquired.

“I argue there’s really only four and a half players left that are meaningful,” Malone said.

Of those four, Malone said it was TPG and iiNet that had in recent times been the driving force for competition in the market. “The other two, Primus and Eftel, we don’t see as particularly relevant from a competitive point of view,” he said.

Internode was seen as a business partner and also, like iiNet, as a force for innovation and better service in the market, but Malone said Simon Hackett’s baby was “sub-scale”.

It appeared the iiNet chief saw the nation’s two largest telcos — Telstra and Optus — as the biggest rivals to his company. Telstra has recently dramatically slashed its broadband pricing in a bid to make its offerings more competitive. “You can never hold back on Telstra — they’re huge,” said Malone. “And if they point their cash flow in our direction, there’s always going to be a battle to stay ahead of them. They have the advantage of incumbency.”

As for Optus, Malone noted most of the SingTel subsidiary’s attention was directed at the mobile arena, but the company was “obviously a huge player” still.

Election

iiNet itself has been a vocal proponent for Labor’s National Broadband Network policy. But today Malone said his company didn’t necessarily have a preference for the Federal Election victor come Saturday night.

The reality, he said, was that a Coalition victory would be “better for iiNet in the short term” as the Coalition’s minimalist broadband policy would allow iiNet to continue to extend its network, sweat its existing assets more and broaden its reach into new areas courtesy of the backhaul network extension it shares with Labor’s NBN policy. “In the short-term, it’s a plus,” he said.

In the long term, however, Malone said Labor’s NBN would give the nation a better long-term platform and certainty. “We wouldn’t have a preference for either Government to get up,” he said.

Results

iiNet’s financial results for the year to 30 June reflected a degree of growth in both the company’s top and bottom lines. Total revenue grew 13 percent to reach $473.8 million, with profit up 34.7 percent to hit $34.5 million and earnings before interest, taxation, depreciation and amortisation was up 20 percent to reach $80.7 million.

iiNet now has 539,000 broadband customers with the acquisition of Netspace — and is slated to add another 113,000 more with its buyout of the consumer division of AAPT. A strong driver of growth for the company is the continued popularity of its Naked DSL offering — where broadband is sold without a bundled analogue telephone line.

iiNet’s Naked DSL numbers grew 59 percent in the year to hit 106,400.

Other iiNet product lines doing well include its BoB combination telephone and modem — 50,000 have been sold since August 2009 — and its Voice over IP product, which grew from 120,000 subscribers this time last year to reach 163,100 a year later. iiNet is also seeing strong growth in its number of analogue phone connections — numbers rose to 191,400 this year, compared with 145,800 last year.

A key initiative for iiNet in the upcoming several years will be its fetchtv internet television product. The ISP now has over 300 fetchtv customers, after launching the service and associated set-top box in July. However, Malone said the company has not yet conducted any formal advertising for the product.

Overall Malone positioned the company as on a path to becoming “the clear leading challenger brand” in its home turf — Australia’s broadband sector — posing a threat to the nation’s second-largest telco Optus.

Image credit: iiNet

iiNet still offers no service in my area. I have the choice of TPG and Telstra. Today I had a Telstra engineer tell me that TPG’s DSLAM has a faulty port and that’s why I keep getting dropouts, and TPG told me “LOLKWORKSFORME” and hung up basically.

And that my friends is a non-sequitur filled paragraph.

This is indeed one of the more impressive paragraphs I have seen on Delimiter.

What Internode lacks in market share, they more than make up for in service – they have been brilliant! They are also constantly voted in the Top Two best ISPs on sites like Whirlpool…

Yeah I agree — I would probably only pick either iiNet (who I am currently with) or Internode for my personal and office broadband.

Best ISP I’ve ever used.

Very interesting Renai,

One of the problems about not having the scale is how to innovate your product in a way that is meaningful and adds value – and therefore adds customers.

I think that what is missing here is that there are other challenges as well as scale.

For instance with when you just compete on price (which can be somewhat easy to do as long as you have an appropriate cost base) – for instance with each internet plan there are three knobs that you can dial up/down – price, data and speed, you then make a certain amount of money.

With this you have to provide support, fund capex (read DSLAM build), marketing, innovation and the like – once you have scale then the number of customers that you get to spread this across on a cost per customer is reduced and you have a serious competitive advantage.

At some point, when everything is essentially the same (the same value for money for each particular customer at their particular price point plus or minus $5), then what is important to the consumer – I think it is customer experience, brand (and the good bits that each brand represents over the other) and the level of innovation. Scale is important. So are making profits – without them you cannot reinvest in innovation.

Innovation is how you stay on top, and stay relevant.

Hmm. I think the key point here is that Malone is thinking on a different level now — he is really thinking in terms of taking on the big guns, Telstra and Optus.

Does Internode have scale? Definitely. But for someone like Malone, he’s now thinking on a different level. This won’t stop Internode competing against iiNet etc — but it does mean that someone like iiNet won’t notice competitive efforts from Internode as much as it does competitive efforts from Telstra, for example.

I suppose I’m half flattered to have my ‘baby’ considered to be ‘half’ a proper market player; But I think we’d have to agree to disagree about that characterisation :)

The question of what scale is enough to have ‘scale’ in the industry is an interesting one. And that size is perhaps something that exists differently in the eye of each beholder.

Internode has far and away sufficient scale to have, for instance, a better and more developed national and international network than iiNet does (literally spanning the globe); A leadership position in IPv6 and other forward looking technologies running on that network, and a customer service reputation that continues to rate annoyingly better than that of iiNet in independent national surveys.

Its perhaps worth reconsidering the merits of scale in the light of how our staff and customers see Internode… while its not an original phrase, it fits us just so well, and its this:

“Big enough to deliver, small enough to care”

I also find resonance in a comment from a recent industry discussion about Apple, which said this about market share (in the context of Apple products and services:

“Market share is not a user feature”

In summary, If I only have half a glass, well, I consider it to be a glass half full :)

Regards,

Simon Hackett

Founder & MD

Internode

Thanks for the response Simon!

I personally agree with different aspects to what both you and Malone are saying. Clearly Internode does have scale — enough to compete on any level with the likes of iiNet and so on. However, reading between the lines, I think what he is also saying is that any competitive effort from Internode is not going to have the overall impact on iiNet that a larger company like Telstra or Optus might have.

However, I also think there are questions to be asked as to why Internode has not acquired other companies — as iiNet has — to grow its scale and become a bigger player? I assume that you guys have a different business plan — and that that business plan doesn’t necessarily involve getting as big as iiNet.

That’s not a bad thing — different horses for different courses :)

Also, I personally prefer to deal with companies that are ‘big enough to deliver, small enough to care’ :)

Expansion through acquisitions does not necessarily make a stronger company. iiNet’s biggest danger is becoming like Telstra where customer service means nothing and they exist simply to serve shareholders interests rather than customers interests.

Correct.

Also remember that Internode are still a Privately Owned company, the only one left in all of the Larger companies out there.

This means they’re growing on their own steam, and self-sustaining, whereas companies like iiNet, TPG, Optus and Telstra are actually being sustained by their investors and Shareholders, to a degree.

iiLike

Comments are closed.