news The Federal Opposition this week pledged to force tech companies like Apple and Google to pay their “fair share of tax in Australia”, with Shadow Communications Minister Jason Clare describing Apple Australia’s claim that it should only pay $85 million of tax on local revenues of almost $8 billion as “extraordinary”.

Earlier this week Apple sent its annual financial results document to the Australian Securities and Investments Commission. The document can be downloaded in PDF format here.

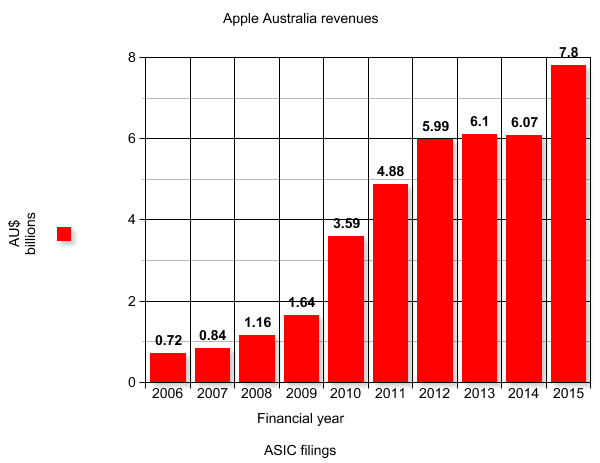

In the document, Apple reveals a remarkable set of figures about how its Australian operation has fared over the past 12 months. The company’s total revenue from its Australian operation rose by 29.5 percent in that period. The jump means that Apple made an extra $1.8 billion in its 2015 financial year compared with its 2014 financial year, with the company pulling in a total of $7.8 billion over the period from Australian customers.

However, despite the huge gain in its revenue in 2015, Apple’s Australian financial results reveal it only paid an extra $4.5 million of corporate income tax expense in the period, making a total of $84.9 million, compared with $80.3 million the previous year, when it made $1.8 billion less revenue. The company also claimed that it made $44 million less Australian profit than it did the previous year, for a total of just $208 million.

In response to the issue, Apple issued just a single statement, saying: “Apple Australia pays all taxes it owes in accordance with Australian law.”

The Federal Government last year passed legislation designed to tackle the tax situation of multinationals operating in Australia, and Treasurer Scott Morrison this week announced further measures as part of an international cooperation deal signed in Paris. In addition, the Australian Taxation Office is actively auditing Apple right now.

However, in an interview on Sky News on Wednesday, Shadow Communications Minister Jason Clare said the Government had not gone far enough on the issue.

“Here’s the biggest company in the world that made $8 billion in revenue in Australia last year and only paid $85 million in tax- that’s extraordinary,” Clare said.

“The other point I’d make Kieran is it’s even more extraordinary that this Government doesn’t have the courage to do something real about it.

“We’ve got a proposal in front of the Government which would make sure that multi-national companies pay $7 billion more in taxation to the Australian people over the next decade and the Government has rejected it out of hand. It should look at that again and do something serious about multi-national taxation.”

Clare pointed out that the Government had not attached a financial total for additional tax it believed it could raise through the multinational tax legislation it passed last year.

“We’ve got an additional measure that we have put forward to the Government. It will raise an additional $7 billion over the next decade for the Australian people from companies like Apple and Google that we think need to pay their fair share of tax in Australia,” said Clare.

“The Government has said no sorry that’s too hard, we are not going to do anything about that. Well I think that is pretty disappointing as well. People expect better from their political leaders when it comes to doing something serious about multi-national taxation.”

opinion/analysis

It’s a bit early to say how effective the Government’s multinational tax avoidance legislation will be, but I have to say it’s good to see Labor really starting to make this issue a large one.

Labor claims to stand for Australian workers — it’s not the party of capitalists or business owners. In this vein, you would have to imagine that corporations who send billions of dollars of profits offshore while paying almost no Australian tax should be public enemy number one.

Image credit: Parliamentary Broadcasting

Again, Apple Australia sells boxes, with a small margin. There is no exploitation of Australian manufacturing workers by overseas capital occurring.

And those same boxes sell at a lower retail price and a larger margin overseas. The shipping costs to Australia from China vs the USA from China must be much higher…

“There is no exploitation of Australian manufacturing workers by overseas capital occurring.”

The exploitation is with regards to the Australian Government and its tax revenue (and hence Australian taxpayers), not with regard to local manufacturing.

Again, what profit is being generated in Australia such that we have a right to tax it? Retail is low-margin.

All of it, there would be no profit if the goods weren’t bought by the Australian public.

There would still be profit if they only sold online from the US and then .gov.au would get nothing at all (except GST for items > $1000).

Yes, but then they would hardly have any sales. Most sales are plan phones.

Then the phones would be bought by the Australian carriers from Apple US and sold to the public. Again, no Apple Australia involved, and it’s still just box shipping. They might even sell them as a loss leader for their far more lucrative phone plans.

Also Apple sells more than phones you know. They’re the only ones with increasing PC sales these days, and let’s not forget the iPad and watch.

And then we get the tax out of the Telco’s who then either absorb it, or push back on Apple for a lower wholesale cost.

Either way we then get more money.

The simple fact is, if they want to sell into our market then they have to pay tax.

But I bet Apple AUS isn’t charging Apple Global 10% GST on those incoming boxes either and then passing that on to the Govt.

“Apple Australia sells boxes, with a small margin.”

Apple’s margins are well known to be at least 35%. Here they are profit shifting, making the Australian division of Apple pay around 92% (allowing a 8% margin). The other 25% of the margin gets assigned to some other international division. The governments are just realising that the 25% they declared to Australia does not necessarily appear on any other tax declaration, as there’s been no tax document sharing.

I note from those reports that Apple has around $300 million cash in Australia this year. Could it be there to pay taxes if needed?

“send billions of dollars of profits”

Oh FFS. Does anyone understand the difference between revenue and profit? Ugh.

Yes, and it seems Renai does too. The profits seem to be in the transfer price to Australia and very little retail profit.

I’m happy to stand by my comment that Apple Australia has sent billions of dollars of profits offshore. I have examined every Apple ASIC statement since 2006. And as a former journalist at the Financial Review, I can assure you I understand the principle of how multinationals make money in Australia and how they price it with respect to their global head offices quite well.

Oh bullshit.

Apple’s profit is made from extracting value from the hundreds of billions of dollars worth of research and development it does in America. That is where the damn profit is made. Not retail sales in some pissant country. Yet Labor and the Australian media want to lay claim ownership to what Apple does in the US and tax it. Laughable.

If Labor wants more bloody tax from multinationals then Labor needs to create conditions for multinationals to base themselves in Australia, perform all their research and development here, and succeed.

So, how much R&D do they do in Cork to get so many IP payments?

Ireland is just a holding ground. When the money makes it back into the US, to invest or to give to shareholders as profit, it’ll get taxed by the US Government.

When and if it makes it back, yes.

It is fair enough to get paid for the R&D. But a fair transfer price is one where the goods are transfer at a price that they would be if the Apple in Australia and Apple in the US were independent companies. If you want to argue they if Apple Australian were in fact the XYZ company they would still be offered iPhones at the same price, that’s one odd Australian company to operate on such low profit margins. And even with those incredibly low margins, the phones still retail at a higher price than Australians can buy iPhones from other countries, surely if they are paying the same price for their iPhones they must be selling them at a loss.

yeah if Apple AUS was its own publicly traded company its shareholders would have sacked the board so fast they wouldn’t know what hit them with results like that!

$8b in revenue for such a low profit and hence dividend (if any) won’t keep the angry masses happy but yet it keeps governments content?!

Australian retail pricing is roughly the same as US pricing once you take into account currency and GST. And yes, all other retailers, JB, Myer, etc. all have very small margins on Apple products. But they still sell them because the demand is there.

Seems they could learn a thing or two from JB then. JB made about the same profit from half the revenue.

“in some pissant country”

I think you may be reading the wrong website if you want to make comments like that ;)

It is a perfectly apt description for a country that consumes technology rather than creates it, who’s economy lives and dies based on how much coal it can dig up, and who thinks it is entitled to usurp the tax revenue of the hard word and achievement of another country.

Yes, we should be a country that claims credit for a device that nearly every part (for example the processor was designed in the UK) is designed and manufactured by other countries. But hey, they do good marketing.

Bruce, since you worked on the first iPhone. What took more time and money? Examining the other smart phones other companies had produced over the previous 7 years or to decide exactly how big the dot on the i would be. It was the dot right?

If you want to sell a product in a country, you have to pay tax. The only way around that is through Grey importation, (which is still taxed as the importer pays) or through direct sales (which can be captured at customs imports).

Simple situation be a good corporate citizen and pay the fucking tax.

You are so full of shit Renai

I really enjoy your articles and comments, but you are just so narrow minded on this whole Apple Tax issue. As I have said, and many others have said, Apple Australia is merely a glorified reseller.

Are any raw materials used in Apple products mined by Apple Australia in Australia? No

Does Apple Australia conduct any manufacturing in Australia? No

Does Apple Australia conduct any R&D activities in Australia? No

Does Apply Australia buy Apple Products from Apple US and resell them here? Yes

If Apple Australia shut down tomorrow, would there be any difference between Apple Australia providing products to market vs a reseller? No

Seems to pass the glorified reseller litmus test to me as well as many, many others have pointed out in these discussion threads.

Give it a rest – seriously. Labors comments are there to feed the uneducated who believe that ‘a massive company like Apple should pay tax’, without taking into consideration the environment in which Apple operates under locally.

Does Apple bring a product into Australia, and sell that product to Australians?

To do that they have to pay tax. Which by the way they are. Apple are doing nothing technically illegal. However the spirit to which this was intended is being abused to give an advantage to Apple.

This loophole needs to be closed. Apple makes a lot of money off Australians, Some of that money is meant to be captured as tax, to help Australians continue to live the lives that allows Apple to make that money. Apple whether legally or not, is dodging said tax to the best of its abilities.

BTW are you Bruce “Tog” Tognazzini?

Are you Darren from Damo and Darren?

I’ll take that as a yes then, you’re a vested interest.

Is real simple folks, no company on earth, no matter how big and profitable, would waste their time building an 8 Billion dollar per year revenue stream in Australia for a measly return of $208 million in profit!

It defies logic to put in the level of effort required to sustain and grow a business of this size for such a tiny return!

That’s a return of just 2% which is downright absurd!

The logical explanation is they are making a lot lot more money or they wouldn’t be here!

+1000

Maybe Apple should build the NBN for us, they’ll get a much better return on their investment.

You got that right!

Have you seen Woolies EBIT? Thats Earnings Before Income Tax by the way.

Their percentage isnt much different to Apple Australia.

“Labor claims to stand for Australian workers — it’s not the party of capitalists or business owners.”

It’s a shame they think like (Australian) workers. It would be better for Australia if they thought like CEOs and Directors. I would much rather financially literate people run the nation than political organisers.

The three last Labor Adminstrations produced between them just two programs of lasting benefit to Australia: Medicare and Compulsory Superannuation. Labor could also have delivered us the Australia Card* if they had not lied comprehensively about the Powers of the Commissioner (the “Senate flaw” was largely irrelevant). The NBN? Seriously? Three Labor Administrations should have been able to deliver around 20 major achievements if we count their propaganda.

Will Labor actively “go after” Apple et al? Yeah, right!

* The Australia Card was in fact the finest personal ID system ever designed anywhere in the world, and AFAIK is still held as a model to be adopted. But we will now never ever get one. The Big Lie was that the Commissioner could only give personal information to a very restricted set of inquirers. The truth as contained in the Bill as defeated was that the Commissioner could give personal information to anybody he saw fit for any reason he wanted. And the Bill failed ON THAT REASON. I was one of the thousands of campaigners.

To repeat educated guesses, its not hard to see whats going on. Theres a manufacturing cost, with more than one website breaking down what the components cost, so it should be fairly easy to predict what Apple pays to get a finished product.

My educated guess is that 50% of the shelf price is about right and it should also be a straightforward task for Apple Australia to show what they pay for it. The problem is the amount in the middle of those two numbers. Is the markup between the manufacturing and wholesale cost reasonable?

There are still costs in that middle leg, including GST, that people conveniently forget. But a simple audit of Apple Australia (one of which is currently underway) can get the documents to show what they pay to get their products. And I have no doubt that cost is going to be very central to whatever the ATO and Govt decide to do. But I’m not sure they can do much under transfer pricing rules.

To put it another way, is $600 wholesale cost a reasonable cost for an $800 product? Its VERY hard to say no it isnt but if its not, what is a reasonable price? Bearing in mind that $600 is also covering the manufacturing cost (~$400), plus having GST taken out (~$60), PLUS absorbing the distribution cost (~$10?).

This is why this is so hard to deal with. How do you determine there’s a transfer pricing benefit happening? This is not a simple cast of “Apple earned $8b last year, they should pay more”, when they didnt. They still had plenty of costs in earning that amount, so who here is qualified enough to say their costs were illegal?

Renai, you’ve worked for AFR, you know there are manufacturing costs, GST on the import, and distribution costs all before it hits our shores. Those arent small factors with these products.

Comments are closed.