news Four years after it first started talking about migrating its core banking platform to Celeriti, the next generation of CSC’s Hogan system, and five years after it acquired St George, which already uses Hogan, top-tier bank Westpac has finally confirmed imminent plans to start taking action on the issue.

Four years ago, in the wake of the bank’s 2008 acquisition of independent company St George, Westpac first began discussing the possibility of migrating its ageing core banking platform to Celeriti, the new generation of CSC’s Hogan banking platform.

At the time, the move made complete sense. Hogan was already seen as being more modern and flexible than Westpac’s existing platform. With the St George acquisition, Westpac chief executive Gail Kelly would be reunited with many of the technical leaders who had implemented the Hogan upgrade at St George to start with — Kelly having formerly led St George as its chief executive. Merging the two platforms would get the two banks on a common underlying IT platform.

Then too, CSC at the time was in the midst of developing Celeriti, a new generation of its venerable Hogan platform that would allow a number of major financial institutions around the world — those already running Hogan — to upgrade their infrastructure to gain new features and capabilities. Celeriti is seen by the global IT analyst community as offering banks a different, less risky option to the ‘rip and replace’ core banking overhaul which CommBank recently conducted with the assistance of Accenture. More evolution, than revolution, so to speak — with many of the same benefits, if not all.

However, despite the fact that then-Westpac chief transformation officer Brad Cooper hyped up the Hogan choice back in December 2009, things slowed down remarkably after that period.

By October 2010, when Westpac chief information officer Bob McKinnon held a wide-ranging media roundtable to detail the many changes he was making to Westpac’s IT operation, the core banking overhaul plans had been placed on the backburner, with Westpac delaying the timing of the shift until 2014, while it focused on a raft of what it called “Strategic Investment Priorities”, which are described as being focused around customers rather than IT for IT’s sake.

Today, in the bank’s annual financial results briefing, the core banking issue was placed squarely back on the agenda.

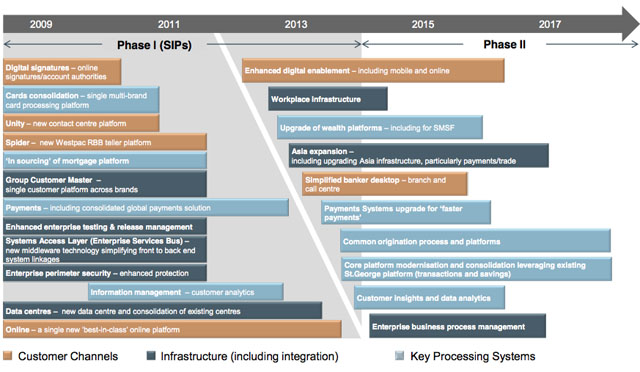

According to briefing documents associated with Westpac’s financial results, phase 1 of the bank’s technology roadmap established back in 2008 and 2009 — including the Strategic Investment Priorities program — is now “drawing to a close”, and work has begun on several “anchors” of phase 2 — including on the core banking issue.

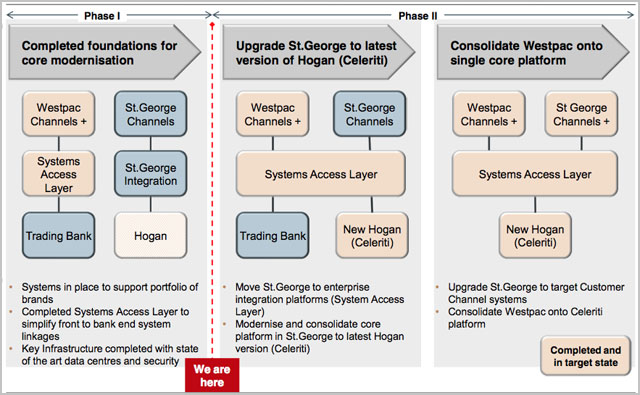

One of the slides details the fact that currently, Westpac and St George are still currently using separate core banking platforms — Westpac on a system it calls ‘Trading Bank’, while St George is on Hogan. Westpac has a ‘Systems Access Layer’ underlying its many channels (retail, Internet and telephone banking etc), while St George has an enterprise integration layer between its channels and Hogan.

The next stage, according to Westpac, is to extend Westpac’s ‘Systems Access Layer’ across onto St George, while simultaneously updating St George’s platform to Celeriti. After that step, Westpac’s underlying platorm will be shifted onto Celeriti.

The banking platforms of Westpac and St George are both seen as currently being outdated, with transfers between the banks and external providers still happening overnight instead of instantly, as CommBank’s platform has the capability to do. CommBank’s platform also offers the near-instantaneous ability to open new accounts and change customer details, as well as featuring integration with its CommSee trading platform. It is thought that the upgrade to Celeriti will offer some of these same benefits to St George and Westpac customers.

There are also a number of other IT initiatives currently taking place at Westpac and its subsidiaries, according to the bank’s presentation today.

Included in the second phase of its technology roadmap are initiatives such as upgrading its mobile and online platforms, deploying renewed workplace infrastructure, an upgrade of its ‘wealth’ platforms (customer investment platforms), including for self-managed super funds, and expanding better technology into its growing Asian operations.

Westpac wants to deliver a simplified banker desktop for its branches and call centres, and it wants to conduct a payments systems upgrade for faster payments. It is also focused on delivering better customer insights and data analytics to its staff, and it is also investigating enterprise business process management.

One of the key deliverables from the first phase of its technology roadmap is currently delivering fruit to the bank. Its number of ‘Severity One’ incidents (outages which have the potential to stop the bank delivering services) has fallen to less than four per month (from peaks of over 30 per month in 2008). Much of this improvement has come about due to “strong progress in infrastructure virtualisation”, the delivery of a new state of the art datacentre and enhanced security infrastructure.

opinion/analysis

You know, I have to say I’m really confused by what’s going on inside Westpac right now in terms of its technology management. It was only two months ago that Westapc chief information officer Clive Whincup — who, you would think, would be informed about these things — told the Financial Review that the bank was not going to immediately pursue a core banking overhaul:

“When we score it on our priority stack it is not the most immediate thing we need to do, so it is further down . . . We do not have to do a core banking rip and replace, and we certainly don’t need to do it now.”

However, just two months later, Westpac appears to be going in hard with respect to its core banking platform, and that of St George. What happened in the meantime? Was the Celeriti migration program finally approved by management? Is Westpac just playing it up in today’s results to keep the analysts happy? I don’t know.

What I will say, however, is that late last week I started the process of switching Delimiter’s business banking accounts away from St George and towards the Commonwealth Bank. Frankly, St George hasn’t conducted any significant upgrades to its online platform for some years, and the bugs are creeping in. The archaic nature of the platform is evident from the fact that St George’s Internet banking functionality goes down every Sunday night like clockwork, as the bank no doubt conducts weekly batch processing functions. I know this for a fact, because I often do late night business banking.

Switching to CommBank was a breeze. Accounts were opened very quickly or in some cases instantly, with little details required and integration with CommSec very easy to set up. The whole experience felt a mile away from St George’s ageing system, and it’s not just the front-end functionality — it’s the back end too, which makes it all seamless behind the scenes. You can’t set up new accounts and transfer money around without that underlying functionality — and just using CommBank’s platform for a while as a customer is enough to get the picture that it is radically advanced compared to the platforms of its rivals.

I maintain basic transaction accounts with most of Australia’s major banks, to make sure I keep an eye on where their online technology is up to. And I can safely say that CommBank is waaaay out in front right now, due principally to its core banking refresh. NAB is obviously taking this issue seriously with its own Oracle-supported plans. Let’s see whether Westpac gets its machine into gear with CSC as well. Because right now, it is falling further and further behind. I say that as an informed IT commentator, who’s been following Australia’s banking IT scene for the better part of a decade — as well as just an ordinary customer.

In 2013, Australian banks are essentially technology services providers — not just financial services providers. And Westpac’s underlying platform is in sore need of an upgrade.

Image credit (tables): Westpac

Interesting. Did anyone tell Westpac that CSC has done a global deal with SAP to promote SAP Banking Solutions to Hogan users?

URL?

Here is the link : http://ovum.com/2013/07/25/sap-and-csc-banking-alliance-provides-a-credible-route-for-core-banking-transformation/

and it says “SAP banking platform provides a credible modernization option for Hogan customers”.

Does it mean CSC is prompting a Blend of SAP and Celeriti…depending on the core capability.

If they have partnered with SAP then should not be competing on the core capability, should be supplementing or complementing each others capability.

IN summary from the article.

The challenge for Hogan customers is that the modernization paths available have largely been unappealing. In terms of functionality, the system is relatively advanced, which makes the business case for change problematic, particularly if it evolves the risks and costs of moving to a new platform. CSC had developed a modernization approach that in part utilized an enterprise web services layer (part of the Celeriti suite) to allow its system to be evolved over time. While this remains an interesting option, many banks have been understandably cautious about having a rather unknown end-point with this approach. By partnering tightly with SAP, CSC can offer clients the certainty of a proven platform for top-tier banks, a broad services capability, and a streamlined migration approach that leverages their combined understanding of both existing and target platforms.

In terms of ‘bugs’ creeping into the St.George banking platform, is that they have people developing and testing the software that have next to little idea of what they’re doing. St.George rarely had bugs in any of their software. I’d say the lack of modernization, and introduction of more bugs, is largely due to the outsourcing of all the IT roles from St.George Bank to Infosys India. They’re just not capable to implement them, or maintain the software in the same manner.

Infosys India has got nothing to do with SGB except for the fact that they handle part of Testing services. Westpac has Fiserv solution for its online interface and in-house “Trading bank” which is an outdated dinosaur still being supported by in-house Core systems permanents while SGB has Compass (in-house), the front end for online banking and Hogan (CSC) for the Core platform.

Comments are closed.