Telstra chief executive David Thodey appears to be taking a dramatically different approach to remunerating its top executives compared to his predecessor Sol Trujillo, with new executives coming on board over the past several years attracting pay packets millions of dollars less than those they are replacing.

Trujillo, who governed Telstra from mid-2005 through 2009, attracted a great deal of criticism from shareholders and the wider community for the high level of remuneration which he personally attracted from Telstra, as well as the pay packets earned by a number of executives he brought with him to the company, commonly known as ‘the Amigos’ due to Trujillo’s Mexican descent and their often US origin.

Trujillo himself, for example, was paid amounts ranging up to $13.4 million each year over his tenure, although the executive was already independently wealthy due to his long history leading telecommunications companies overseas. One of his chief lieutenants, then-Telstra chief operations officer Greg Winn, earnt about $21 million over three years leading Telstra’s technical operations.

The pushback against high Telstra salaries peaked in November 2007, when two thirds of the telco’s shareholders, including major shareholder the Future Fund, voted against Telstra’s remuneration report at its annual general meeting. The telco’s board isn’t obliged to act according to shareholder voting on the matter, but commentators saw the action at the time as a significant warning to Telstra’s board that it wasn’t happy with the company’s management.

However, analysis of executive remuneration stemming from Telstra’s release today of its annual report for the past financial year reveals top Telstra executives today attract salaries dramatically less than they did under Trujillo — especially those hired by Thodey over the past several years.

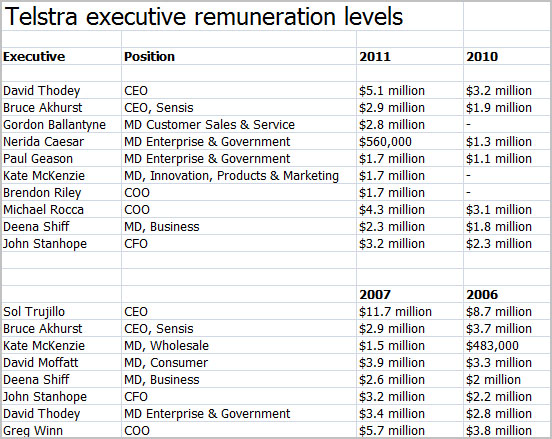

Thodey himself was paid $5.1 million over the past year, for example, and $3.2 million in 2010, compared with Trujillo, who pulled in $11.7 million in 2007, for example, and $8.7 million in 2006.

A study conducted by Citi last month found that Thodey could be considered to be “underpaid”, when the executive’s remuneration was considered against his company’s market capitalisation and performance criteria.

Bruce Akhurst, the leader of Telstra’s media and Sensis-branded assets, earnt $2.9 million over the past year — the same as in 2007. But the executive earnt substantlly more, at $3.7 million, in 2006, and in 2010 he only pulled in $1.9 million.

New top executives to have joined Telstra’s ranks over the past several years at the level of group managing director have generally lesser overall remuneration than their predecessors. For example, the company’s new chief operations officer Brenton Riley pulled in $1.7 million over the past year, compared to Winn’s salary approximately three times that level.

Telstra’s group managing director of Customer Sales & Service, Gordon Ballantyne, only earned $2.8 million over the past year, compared with Trujillo-era consumer chief David Moffatt, who was usually paid up to a million dollars more each year.

Thodey himself appears to have attempted to signal to Telstra staff that he would take a more humble approach to his own salary. In September 2010, for example, the executive announced that some 6,000 staff in Telstra’s Consumer and Country Wide unit would have to take a pay freeze. At the time, however, he also noted that he would personally take a pay freeze alongside them — and the company’s top 300 executives would suffer the same.

Image credit: Telstra, Delimiter

pay peanuts, get monkeys.

Are you saying the Telstra execs aren’t getting paid enough?

the Board should have the discretion to set the necessary level of numeration to attract the best managerial talent. if the Directors are failing in their judgment in this respect, then shareholders should turf them out.

Sol Trujillo was a great hire and an excellent CEO — he did all the smart things and set Telstra up perfectly….. expand mobile (which subsidises the ongoing erosion in “fixed” profitability), upgrade the “core” to facilitate the continued migration from legacy to digital services and show the “middle finger” to the ACCC/Federal Government by not investing in FTTN without pricing rationality.

once Telstra secures their wireless spectrum at the next auction, it’s all over little red rover…

Rofl, Sol T almost single handedly cast the fate of the NBN.

It might have been the best network but they were shedding customers and goodwill like a dog sheds it’s coat towards the end of Sol’s reign.

For Sol & McGauchie to put the Howard govt offside was impressive feat in itself.

But you reckon he was worth it because of nextg and an upgrade lol.

*Rofl, Sol T almost single handedly cast the fate of the NBN.*

universal fibre extravagance is entirely the brainchild of Messrs. Krudd/Conroy. the Government has played its “final hand” (i.e. “massive govt spending” to force outcomes). when the whole project inevitably fall aparts, Telstra’s bargaining position will be further strengthened. there will be ZERO interest in these regional fibre white elephants when a future Government is forced to dissolve NBNco. they will have to turn to Telstra to mop up the mess for 20c in the dollar and there’s no way in hell Telstra will agree to “structural separation” the second time round. the political capital for further intrusive state intervention or massive reshaping of the industry will be completely spent.

what the Labor Government is doing by plonking $50bln (and counting) or betting the farm on ONE technological platform is strategically very stupid. fixed-line revenues are stagnating all around the world and many telcos have scaled back ambitious roll-outs because consumers are not willing to pay more for superfast broadband. meanwhile the wireless market continues to boom (e.g. look at Apple’s market cap overtaking Exxon.) in the same way that some people argue Telstra was “handed its fixed-line monopoly” by a previous Government, Labor, by forcing Telstra to liquidate its interest in (declining) fixed-line, is now positioning the company to further dominate the promising wireless space.

this is hardly surprising — governments are always “backwards-looking”.

*It might have been the best network but they were shedding customers and goodwill like a dog sheds it’s coat towards the end of Sol’s reign.*

the loss of PSTN revenue is an ongoing global secular trend. the loss of retail fixed internet market share was due to regulatory pricing outcomes, competitior DSLAM roll-outs and ULL uptake. even under Sol’s reign, Telstra was rated one of the most valuable corporate brands in Australia (as it still is). just because a couple of WP net geeks are upset at Telstra has little real world commercial significance.

*For Sol & McGauchie to put the Howard govt offside was impressive feat in itself.*

and what did the Howard Government do to them? nothing. and what’s wrong with fighting to protect your commercial interests against irrational regulatory/Government intrusion? this isn’t Russia.

*But you reckon he was worth it because of nextg and an upgrade lol.*

every single dollar. he tried to inject world-class telco management and regulation to this regional, socialist backwater.

Please spare us the bloody minded politics, at least until the next election campaign.

Thank you.

If Sol had played ball with Howard let alone the Rudd government, there would have been no NBN. Howard would have bent over backwards for them, but Sol wouldn’t even give them a cuddle :)

As for their brand, well their complaints were at record levels, and their high price high margins were completely unsustainable in a competitive market.

*If Sol had played ball with Howard let alone the Rudd government, there would have been no NBN. Howard would have bent over backwards for them, but Sol wouldn’t even give them a cuddle :)*

it’s got nothing to do with “Telstra refusing to play ball”, unless by “playing ball” you mean “further devaluing the copper network”. Telstra was planning to upgrade 4mln premises to FTTN using VDSL2. the G9 were planning to build FTTN over a similar footprint. also, they (G9) submitted a SAU to the ACCC which proposed wholesale prices along the lines of $27/mth going to G9 and $5-15/mth going to Telstra for sub-loop access (12Mbit plans). the ACCC found the proposed prices acceptable (but ultimately rejected the SAU on other grounds) — this is COMPLETELY NUTS.

the Analysys Mason report on the economics of building NGA networks found that the cost of FTTH is generally 5 times the cost of FTTN. the crucial point is that the cost or value of the last mile is far greater than the cost of laying fibre up to a node and cabinetization at that point. yet, the G9 were demanding a wholesale value on their (cheap) portion of the network ($27/mth) of twice that of the expensive last mile ($5-15/mth)! the $27/mth is probably reasonably reflective of the marginal cost of building FTTN (backhaul plus cabinets). (after all, why would the G9 want to under-recover THEIR costs?)

however, if the cheap portion of the network leading up to the nodes is $27/mth, what does it tell you about the $5-15/mth value assigned to the expensive last-mile? it’s a GROSS UNDERESTIMATION of the value or cost of that portion of the network. (bear in mind, the $5-15/mth price range that the G9 proposed to pay to Telstra is actually lower than current ULL rates.) if you factor in a more realistic valuation of the last-mile subloop, you will arrive at a more realistic total wholesale cost of FTTN which is closer to Telstra’s proposed prices on its own FTTN build.

unlike the G9, Telstra never actually lodged a SAU based on its proposed prices which were instead communicated informally and in-confidence to the ACCC. there is no doubt the ACCC would have rejected Telstra’s FTTN pricing because of their past form in systematically undervaluing Telstra’s copper network (i.e. ULL was priced as low as $12 at one point in time).

*As for their brand, well their complaints were at record levels*

the Telstra brand is probably worth hundreds of millions of dollars. i wonder how much a telco service provider would fork out to acquire the “Dodo” brand name. as for “Internode”, most people have never heard of it.

*and their high price high margins were completely unsustainable in a competitive market.*

firstly, it’s typical of an infrastructure company to have “high margins” on an EBITDA basis (before depreciation and amortisation). this is because infrastructure companies’ main costs are “initial capital costs”, not “ongoing operating expenses”. Telstra’s net profit margin is only 13%.

what competing fixed-line infrastructure is there to the copper network (other than HFC)? what’s driven Telstra’s fixed-line profitability lower is not price competition from competing infrastructure, but the regulatory straightjacket imposed by the ACCC where other ISPs are able to access the copper network at concessionary rates (ULL/LSS).

note the NBN does not have a similar concessionary access regime. everyone pays the same set of AVC and CVC charges. for a bloody good reason! they don’t want to devalue the capital value of the NBN over time as NBNco has loads of debt to service in the same way Telstra has billions of dollars of dividend and interest obligations to pay out. for some reason, what’s good for the goose is not good for the gander.

notice how the TW MD is the lowest paid under Sol’s reign — this is probably because Telstra Wholesale is the money-losing division of Telstra Corp (flogging ULL at $16 and LSS at $2.50).

Comments are closed.